What Are The Benefits Of Selling The Property Whilst It’s Tenanted?

There are several key reasons why you should consider selling your buy-to-let property with the tenants in situ, the key being that you can generate rental income right up to completion. You also avoid additional monthly expenses, including utility bills and council tax, all payable on a vacant property. Assuming that the average sale takes 4.2 months (Source: The Advisory ‘Time To Sell’ Study), it’s easy to see how these costs can easily start to add up.

It’s also worth noting that in 2024, 28.8% of all property sales fell through, resulting in considerable delays and void periods for landlords looking to sell their properties. Fall-throughs lead to the property being remarketed, adding an additional void period to the overall costs, all of this whilst your mortgage repayments are still payable.

Chain Free Sales – less fall-throughs!

By selling your property directly to another investor, you avoid one of the main reasons for property sales falling through, the dreaded chain! Our investors typically purchase ‘chain’ free resulting in a far higher success rate on the sales progression process.

Why Should I Choose Pure Investor To Sell My Tenanted Property?

We only work with landlords, and our sole focus is to sell the property to another landlord on your behalf. We have a large database of experienced property investors, over half of whom are based outside the UK, but who own properties throughout the UK. Our team is experienced in working with landlords and in selling properties that are tenanted. This experience is critical and gives you the best chance to sell your buy-to-let property with the tenants in situ.

Where Will You Market My Property?

Selling a tenanted property is very different from traditional estate agencies, and simply listing a property on the property portals does not give you the optimal coverage to what is a relatively specialist audience.

We will not only market your property on the major property portals, including Rightmove and Zoopla, but you will also be listed on our main Pure Investor website, which benefits from approximately 300-500 experienced property investors every day. The property will also be marketed to our database of over 31,000 property investors via our in-house marketing initiatives.

As well as being marketed on our website and the property portals, we regularly send our database of property investors the very latest additions to our sales portfolio. Every week this generates new enquiries from investors looking to purchase tenanted buy-to-let properties such as yours to add to their portfolios.

If you’re actively looking to sell your tenanted buy-to-let property, why not get in touch today and we’d be delighted to send you through some examples of our recent email and WhatsApp broadcasts for you to have a look at?

Will You Provide Me With A Valuation On My Tenanted Property?

Yes, whether you’re actively considering selling your tenanted property, or simply curious as to its current valuation on the market, we’d be delighted to provide you with a valuation on a free-of-charge, no-obligation basis.

Will You Require Access To My Property To Sell It?

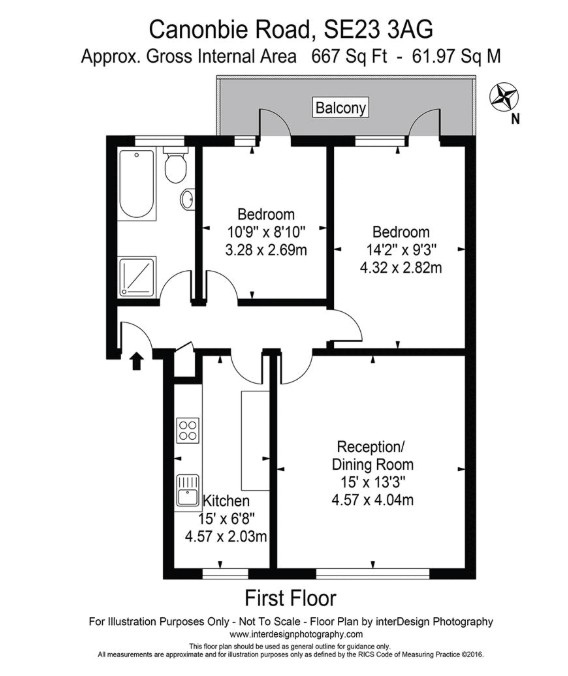

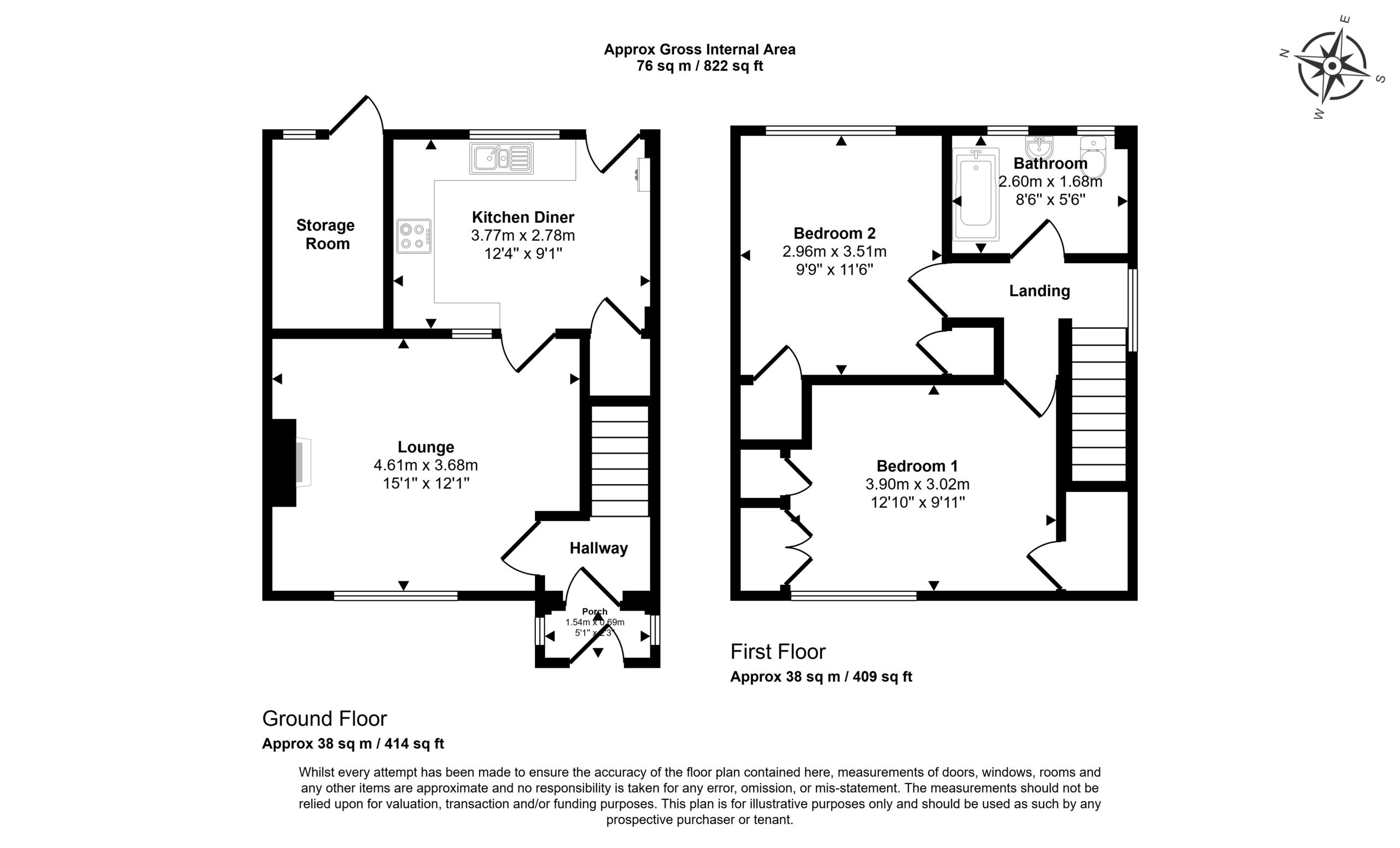

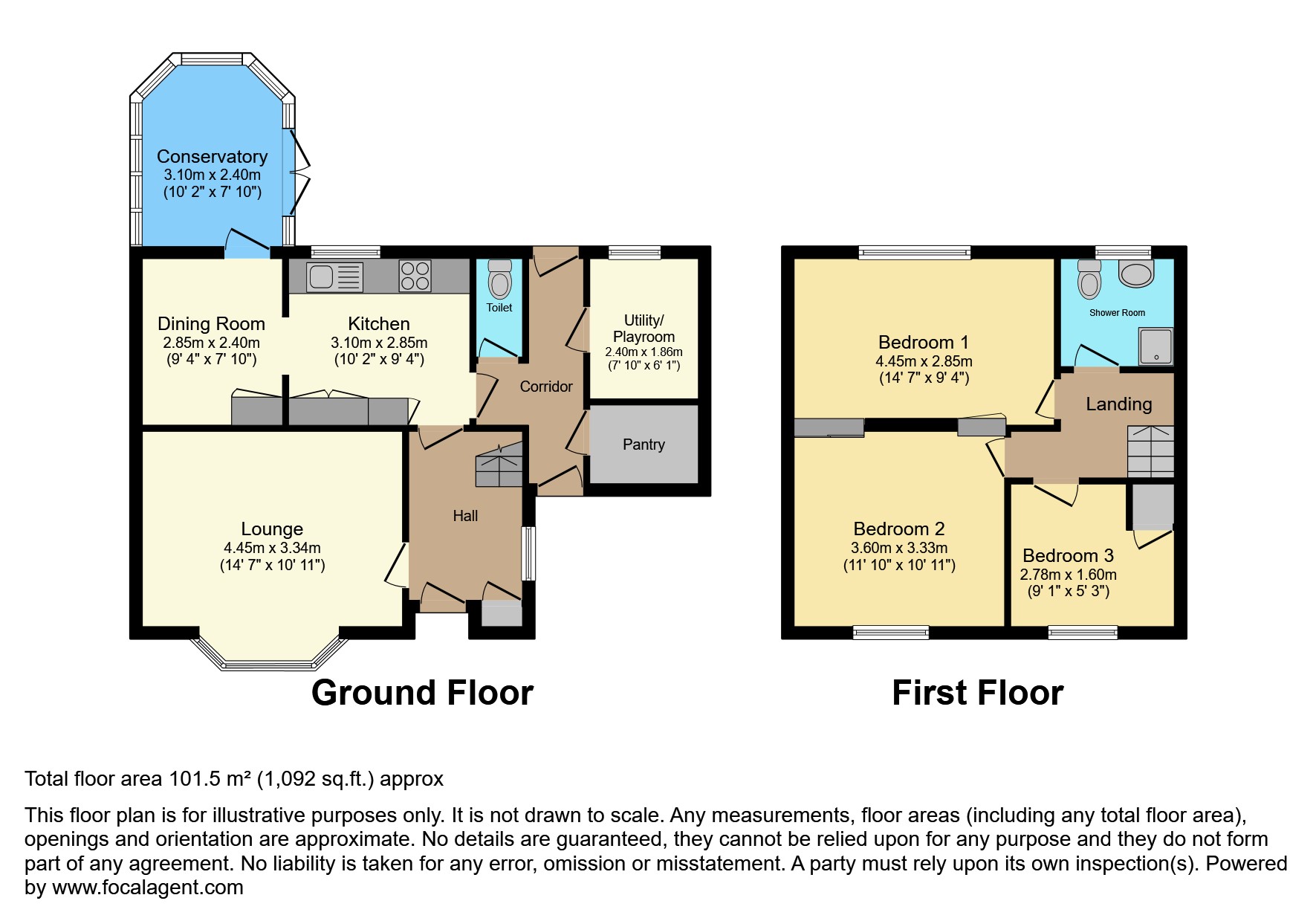

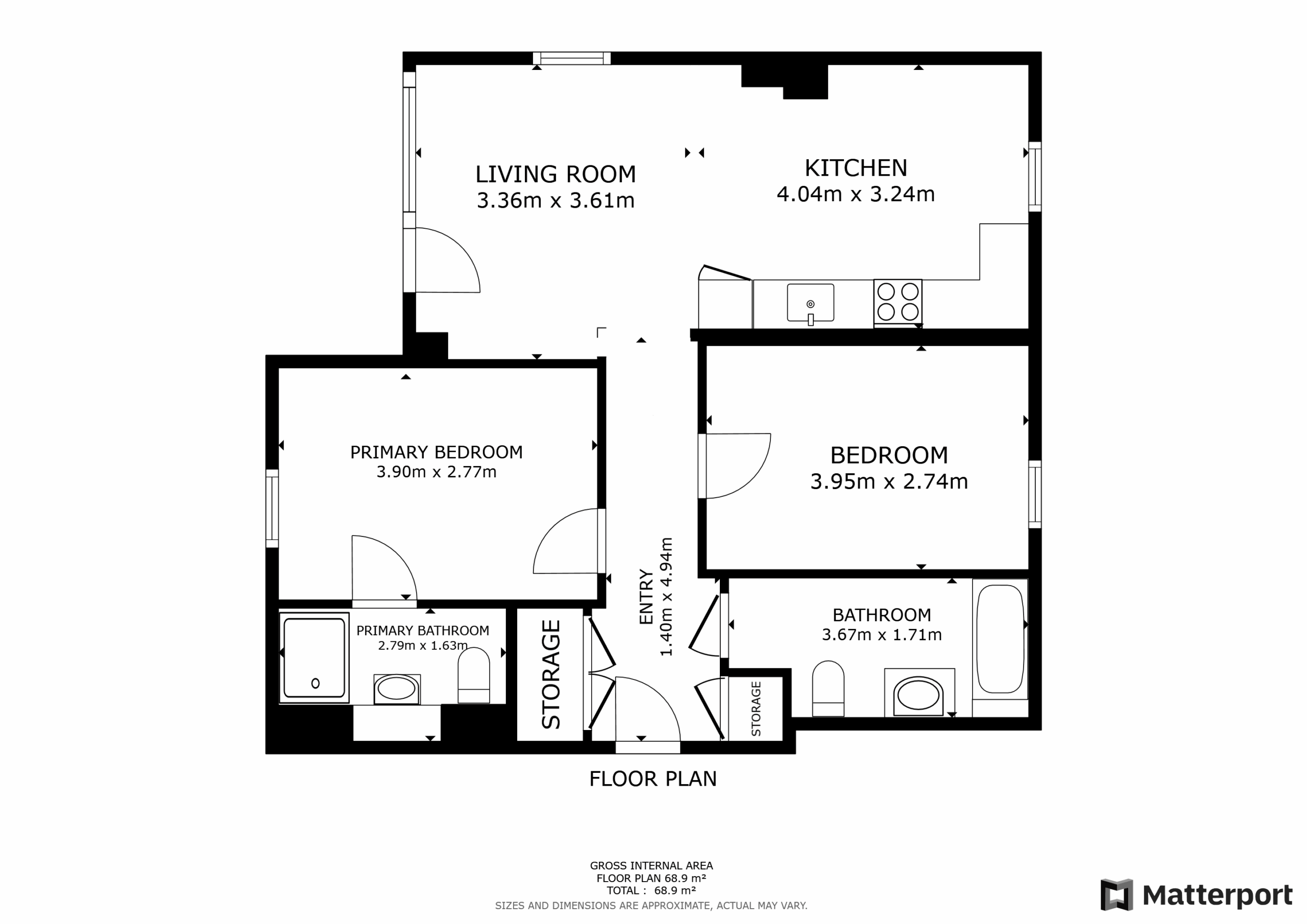

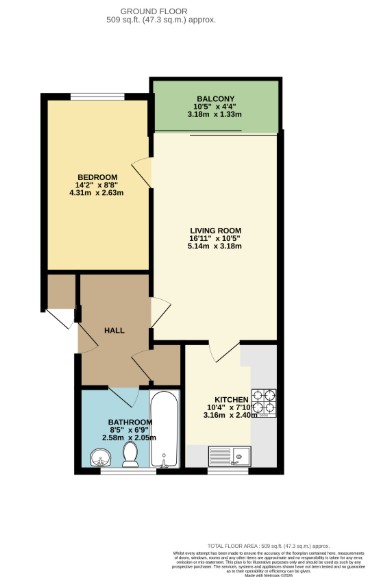

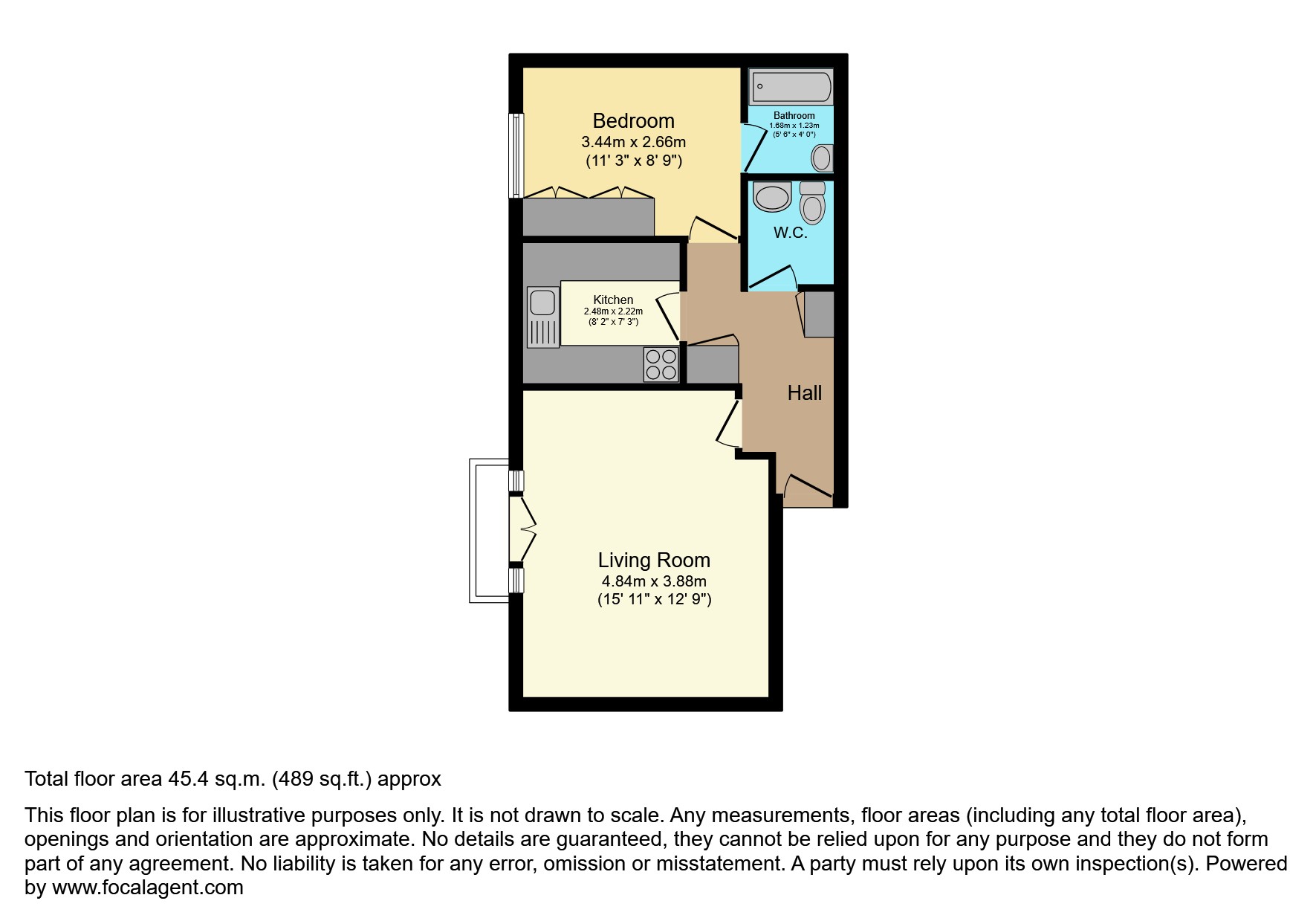

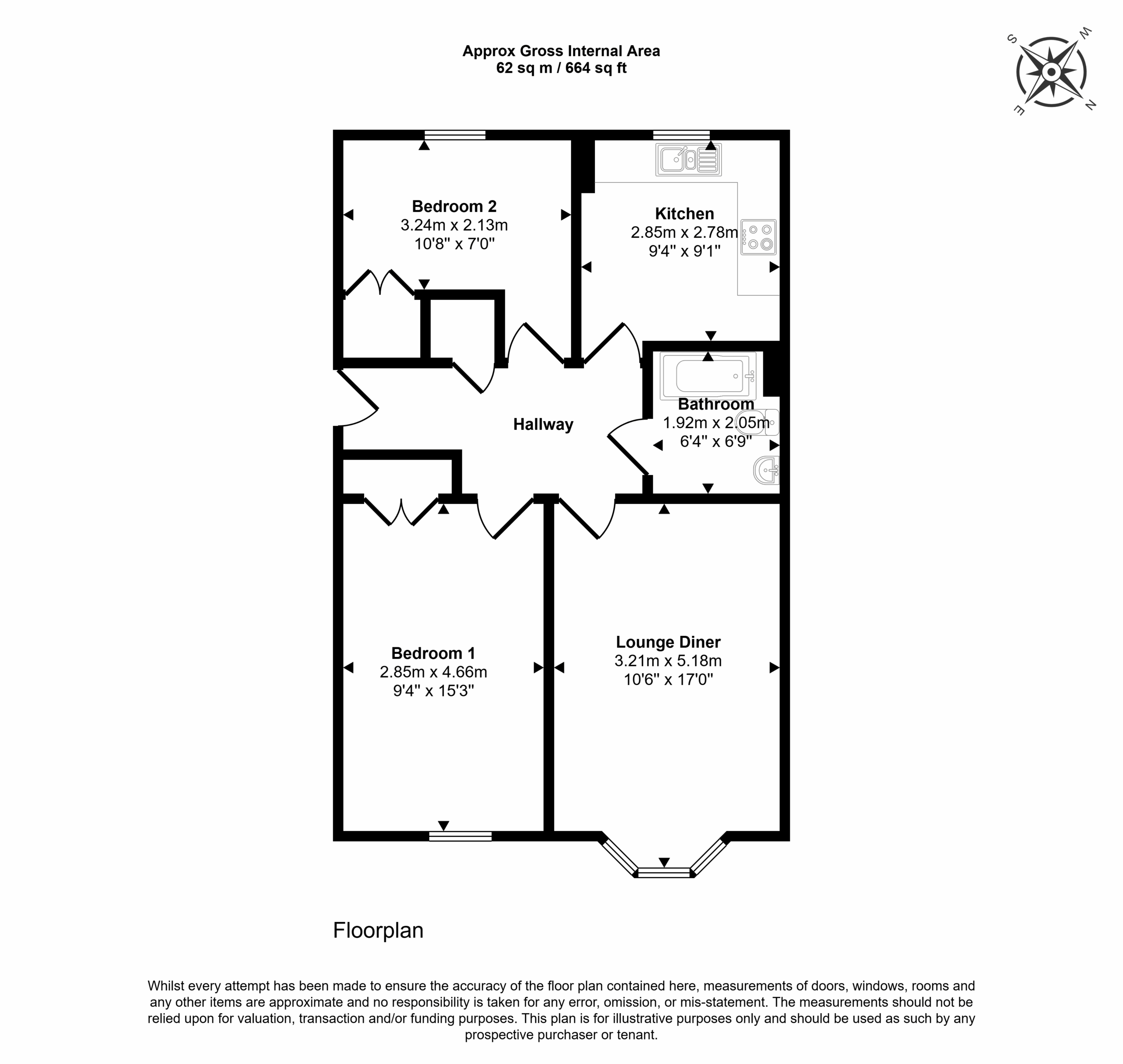

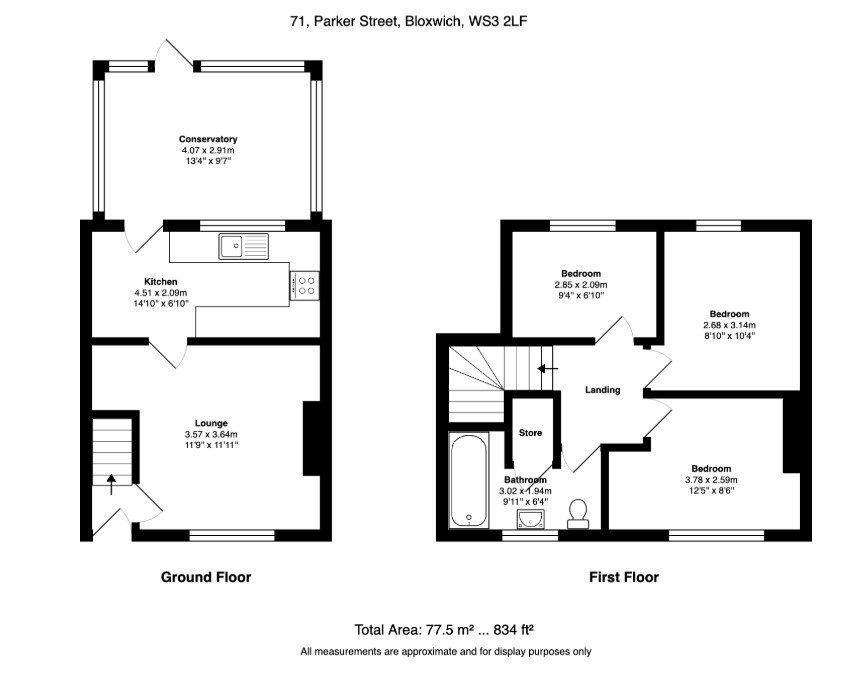

As with all property sales, we will require access to your property to compile the relevant marketing information and photography. We want to present your property as professionally as possible, and it makes sense for us to visit the property as early as possible in the process.

Key to a successful sale is honesty and transparency with all parties. It’s worth noting that the most effective way for us to arrange access to the property is directly with the tenants rather than through any third party. In our experience, we’ve found the vast majority of tenants want to stay in their property, and are happy to work with you once the process has been explained to them. Throughout the process, we will respect the tenants and their right to a quiet and peaceful environment.

Good, effective marketing including detailed photography and walkthrough videos often remove the requirement for multiple viewings. We also work closely with prospective buyers to ensure that there is a genuine interest, and ability to proceed prior to booking any viewings at the property.

How Do You Work With My Tenants?

We’ve found that the key to a successful sale is to work with your tenant in an open, honest and transparent manner. Throughout the process, we will be respectful of the requirements and rights of your tenant to ensure a smooth and seamless transition through to completion.

From the outset, we will explain that we work solely with landlords, with a view to selling them a property with a tenant in situ. A good quality tenant is a positive for both the landlord and the tenant, and open and honest communication with all parties from the beginning of the process is crucial to achieving a successful sale.

I Already Have A Good Lettings Agent Managing The Property. Will You Be Looking To Change This?

No, as above the key here is honest and transparent communication from the outset. The key objective for our landlords is to purchase a property which is managed and already generating a rental income. As such, we’re happy to include the information from your existing agents to present a more managed investment option.

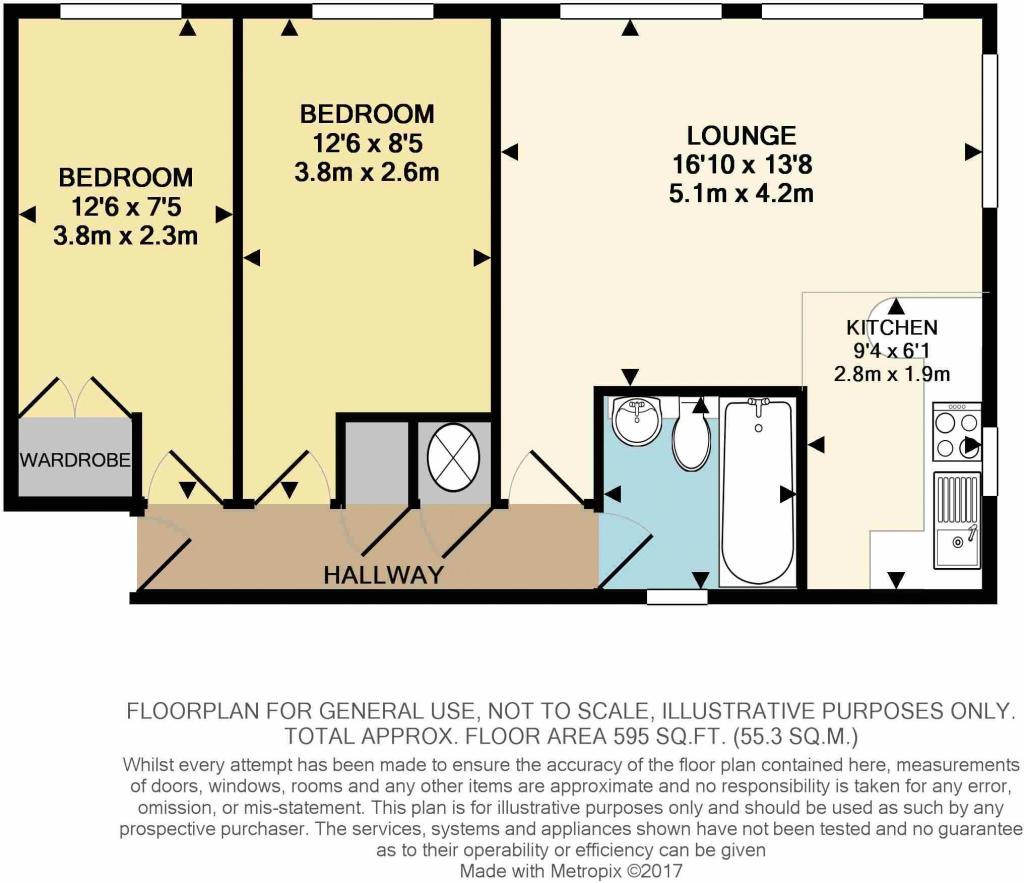

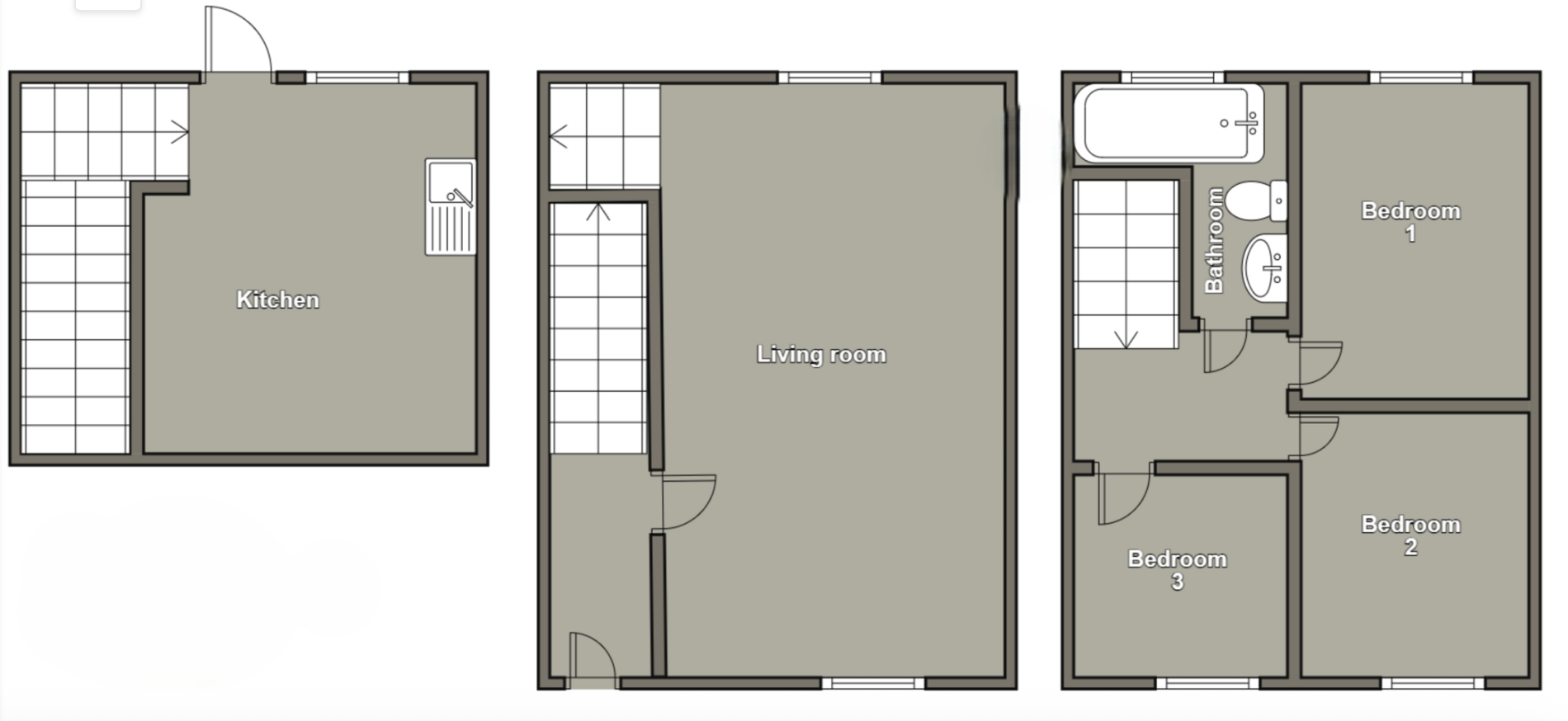

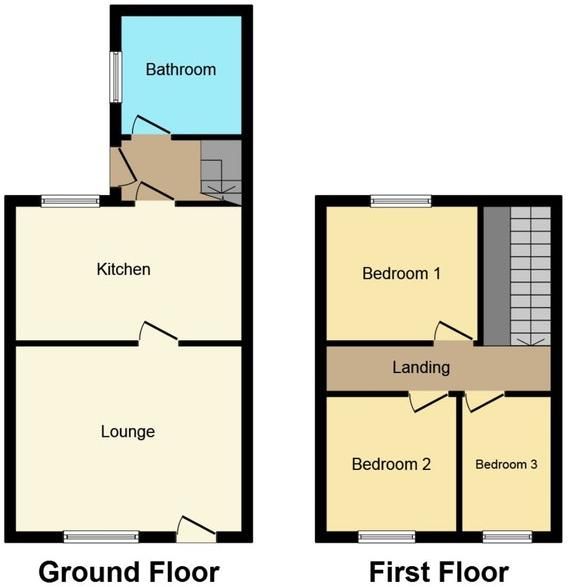

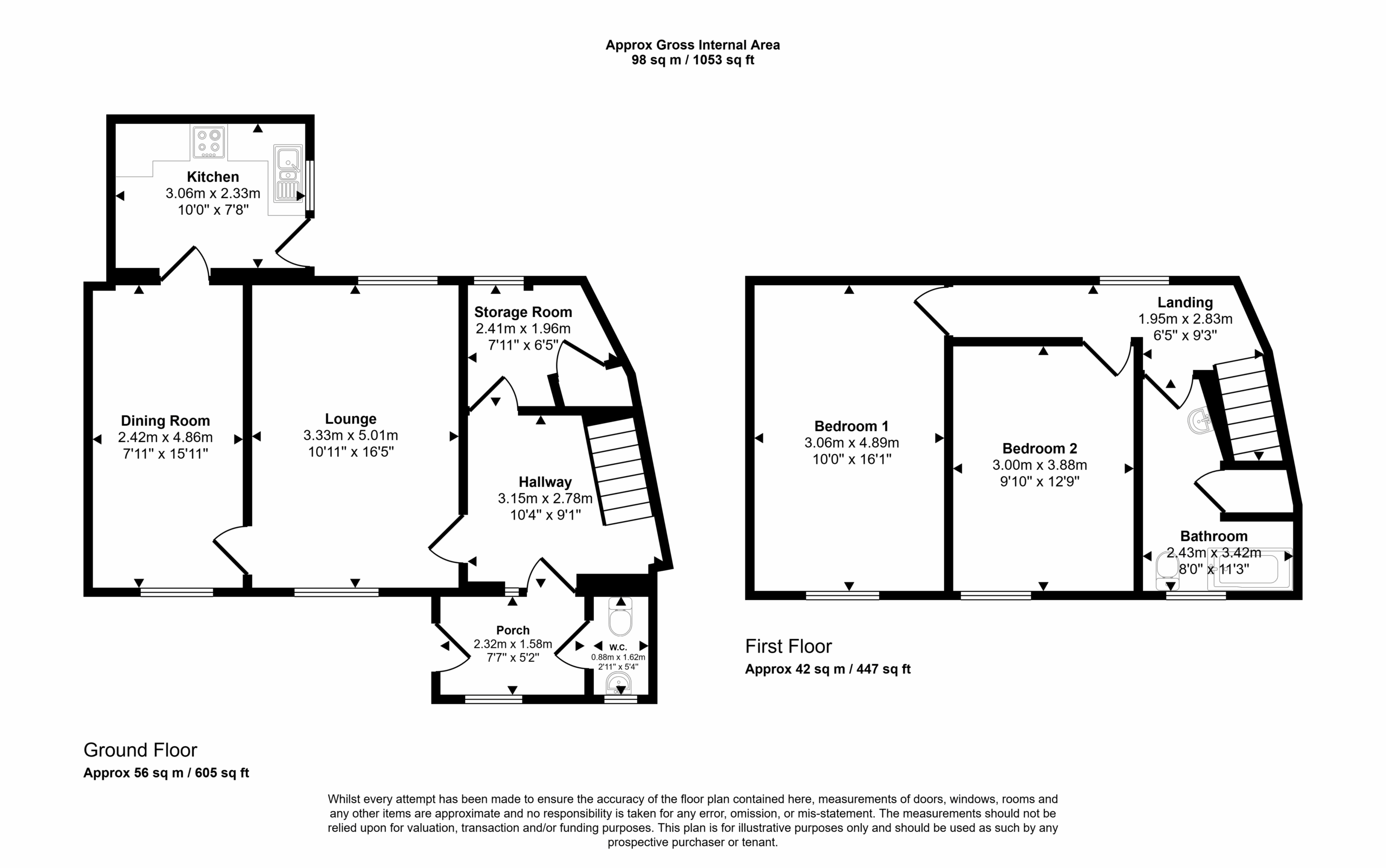

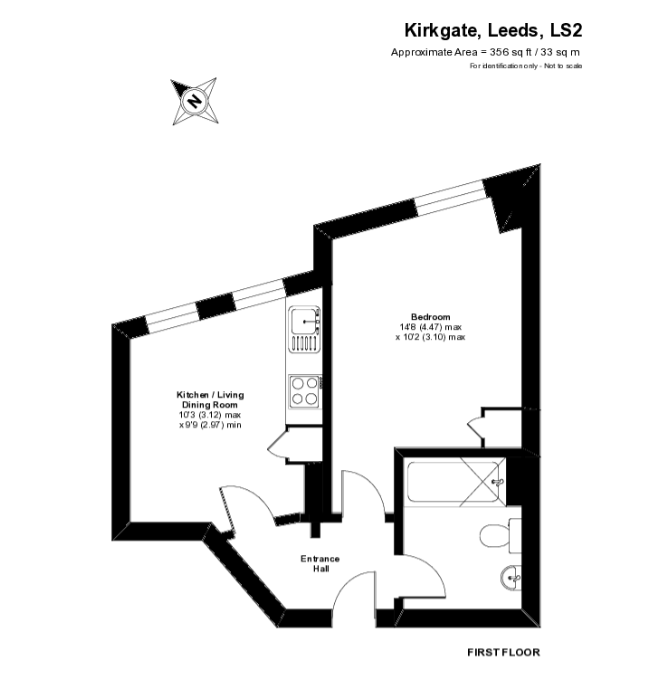

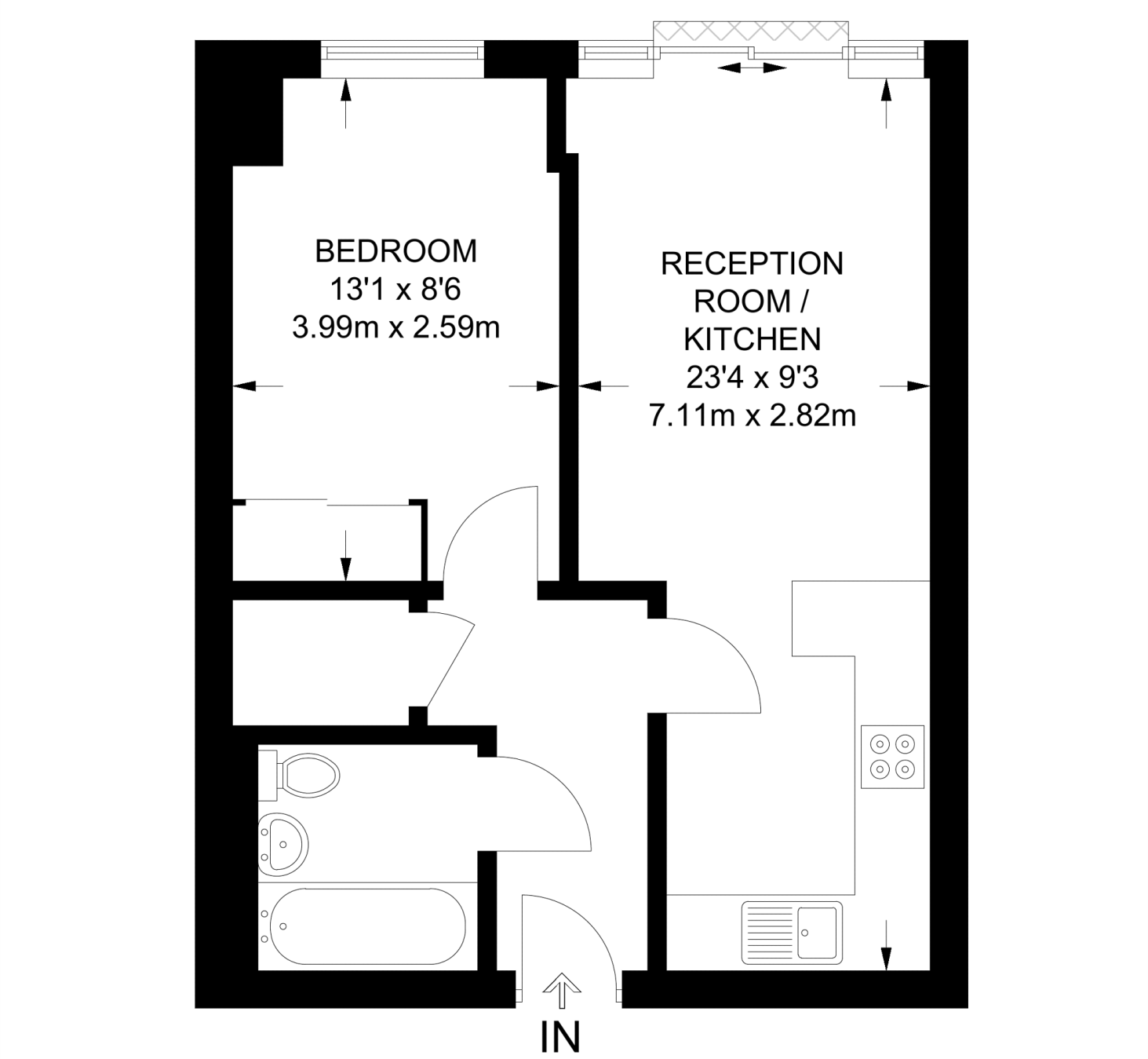

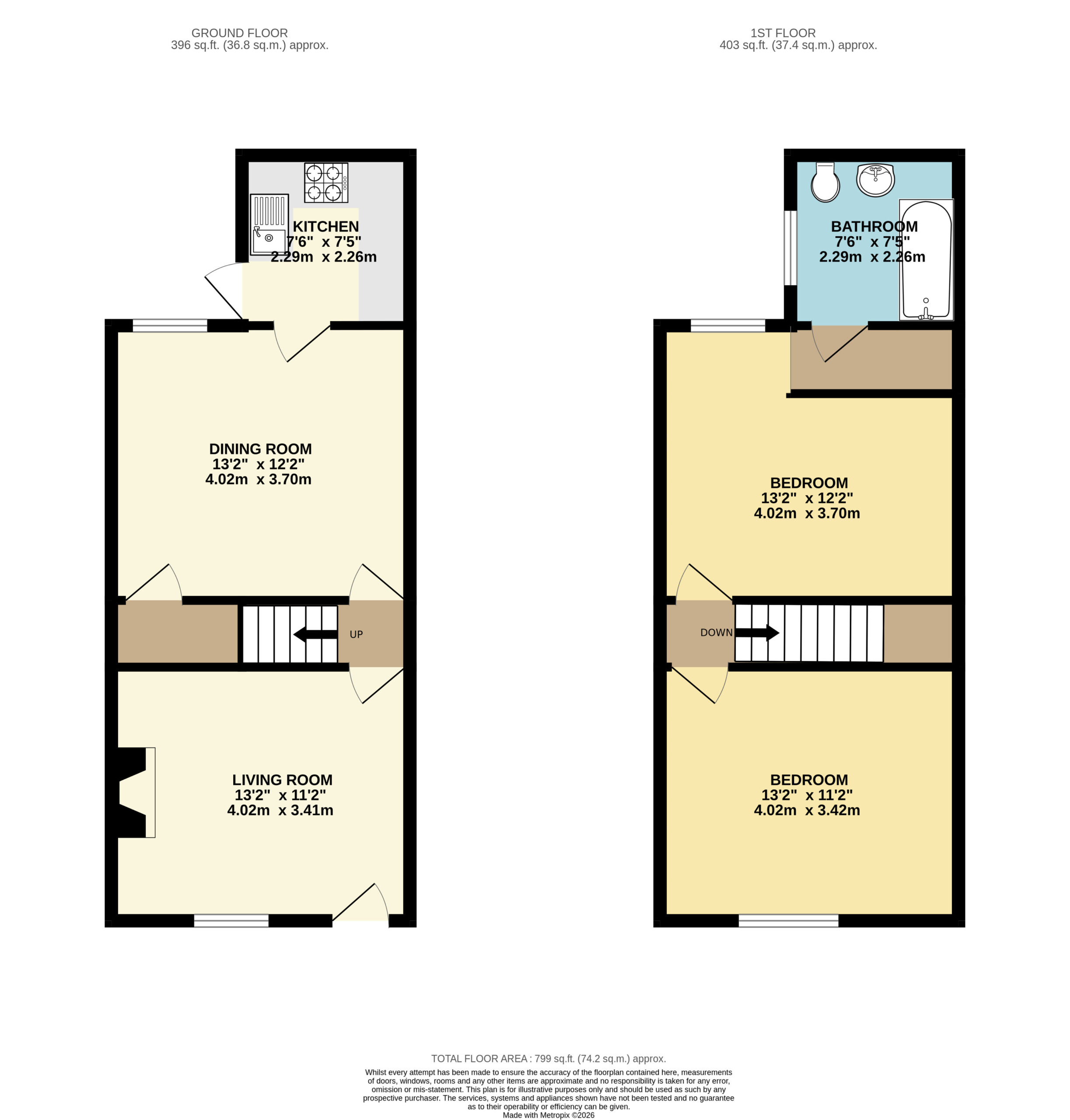

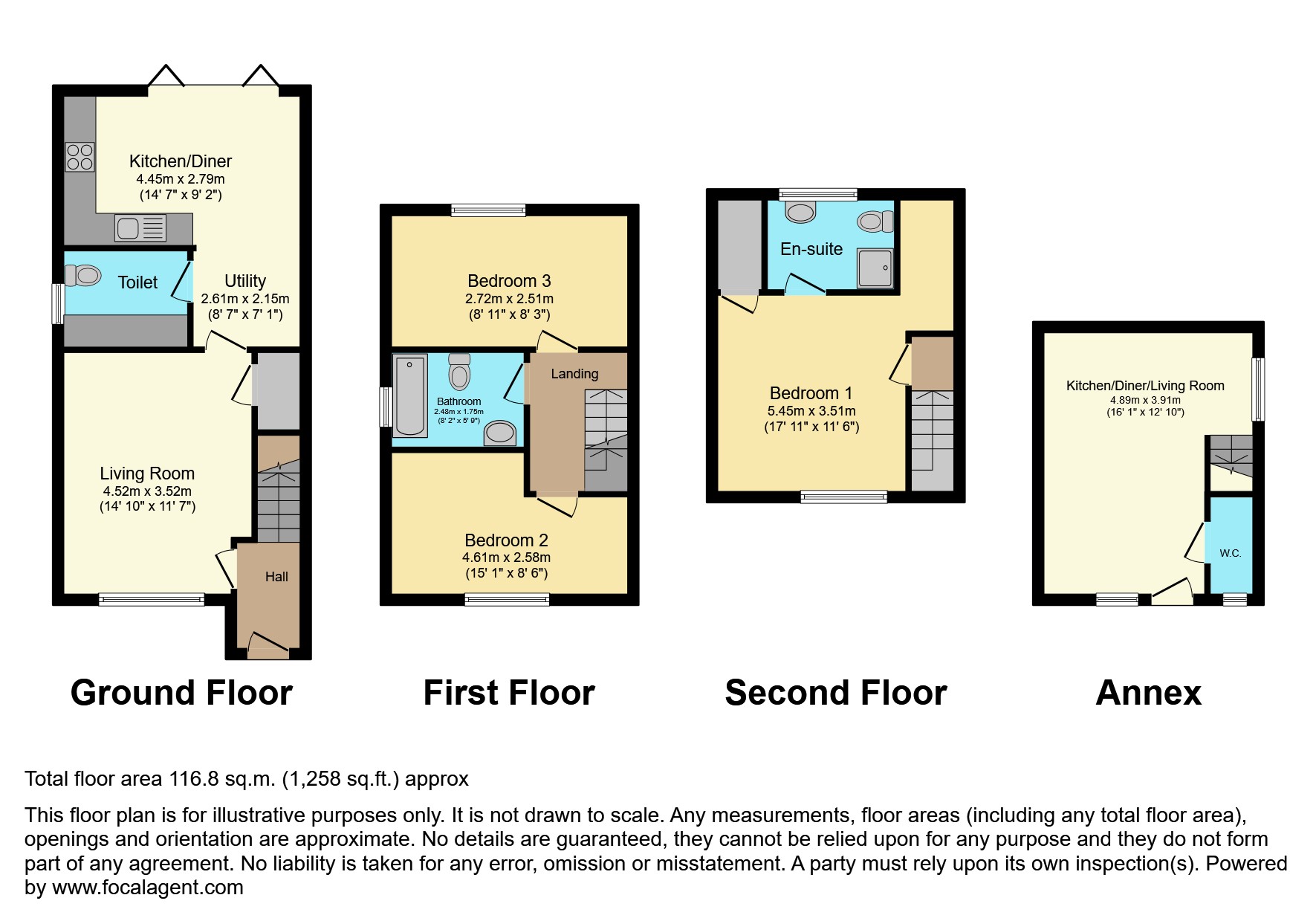

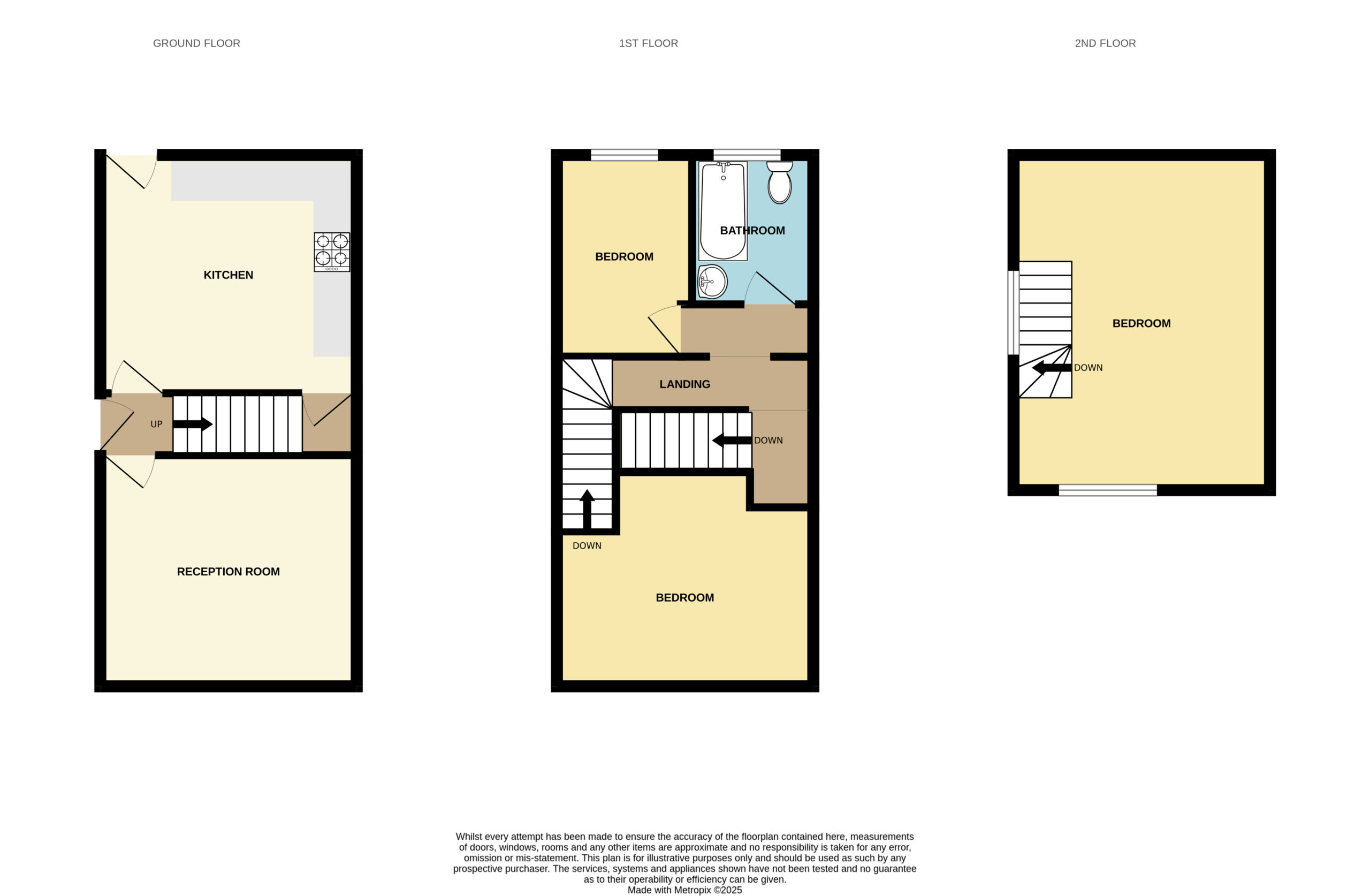

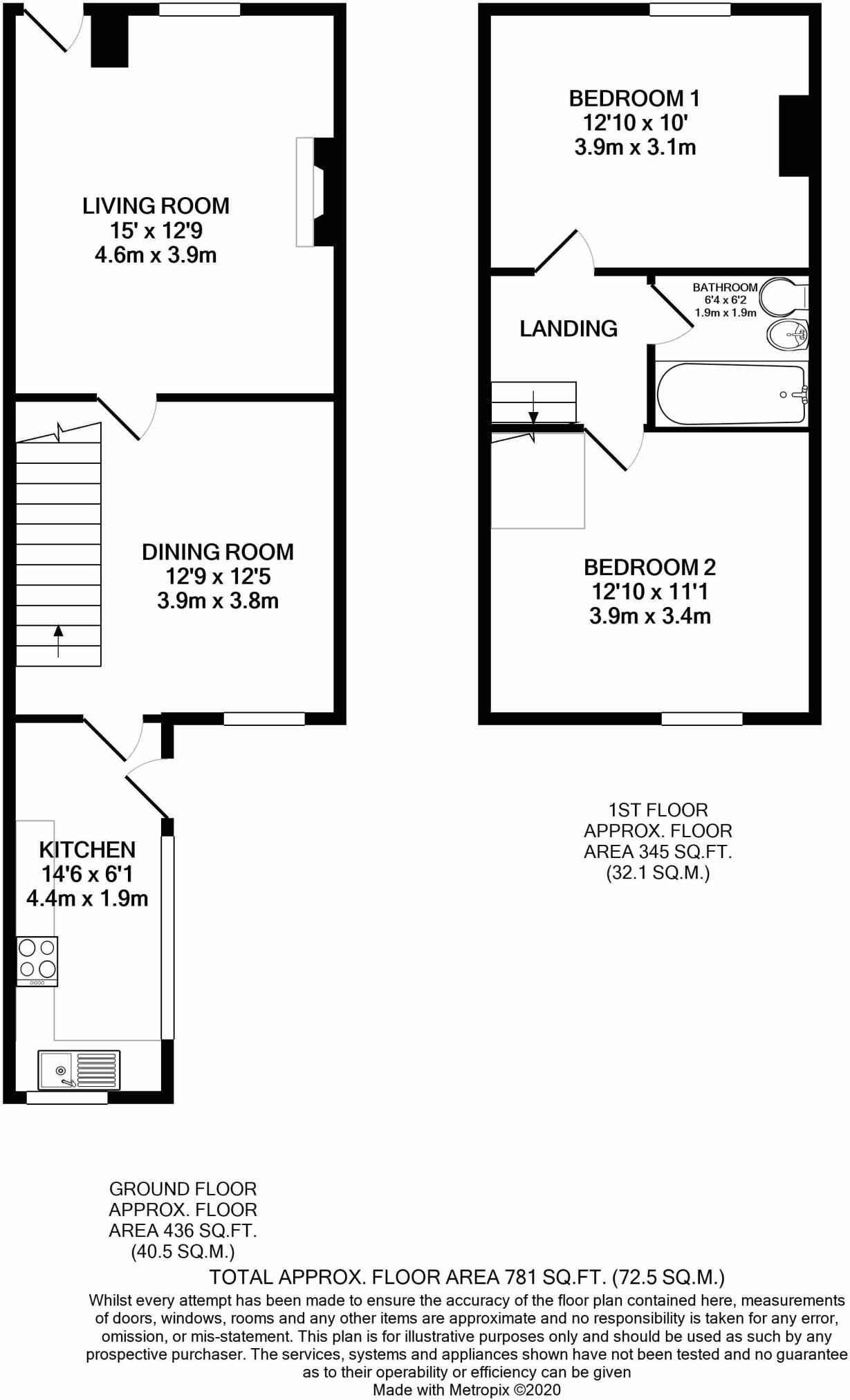

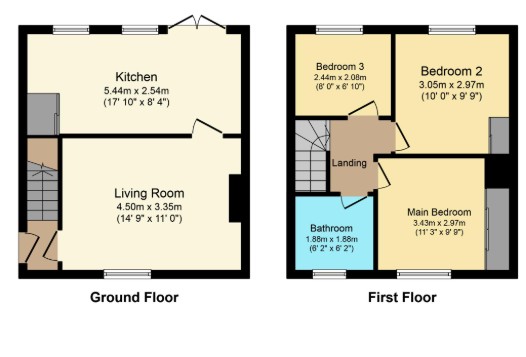

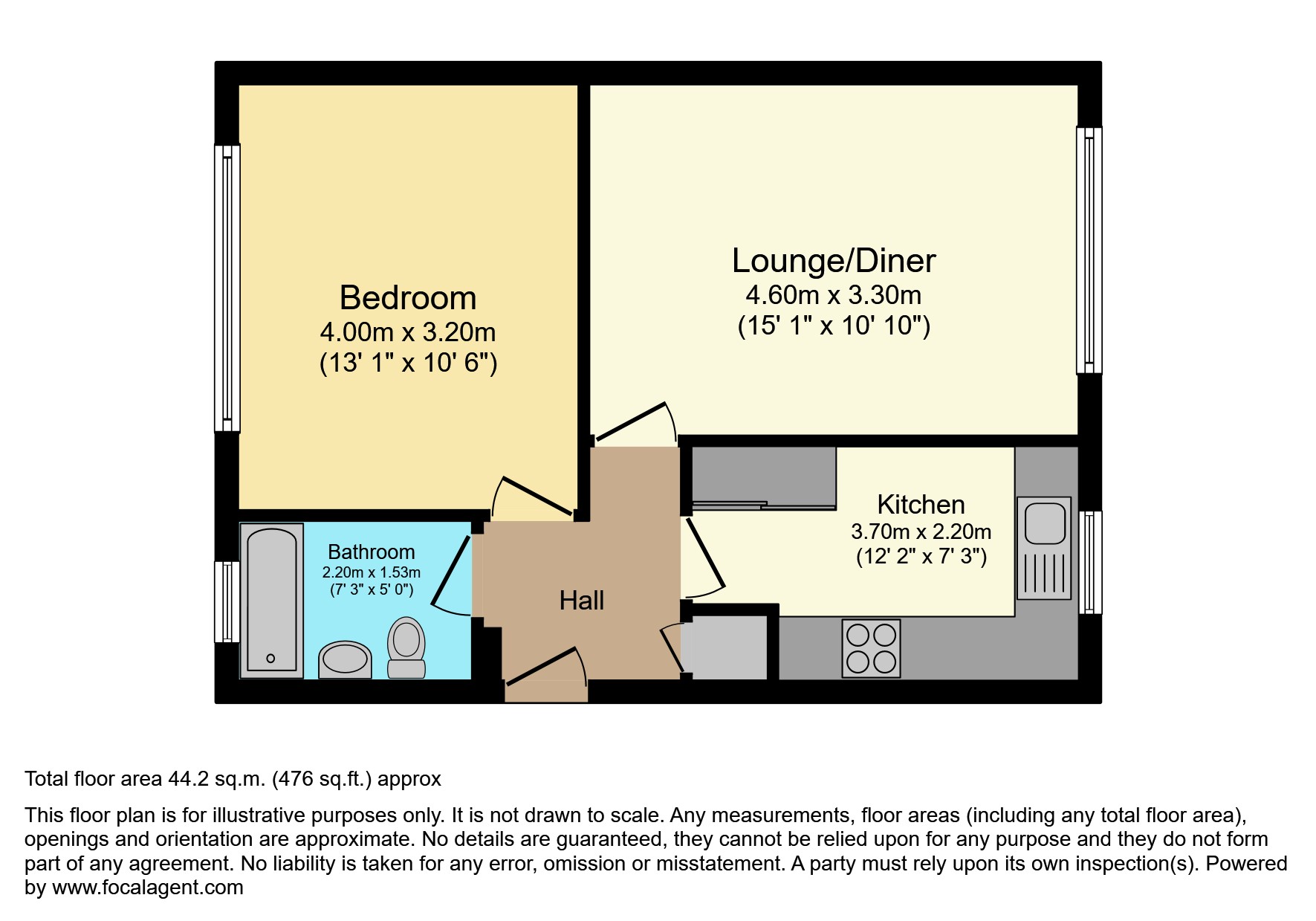

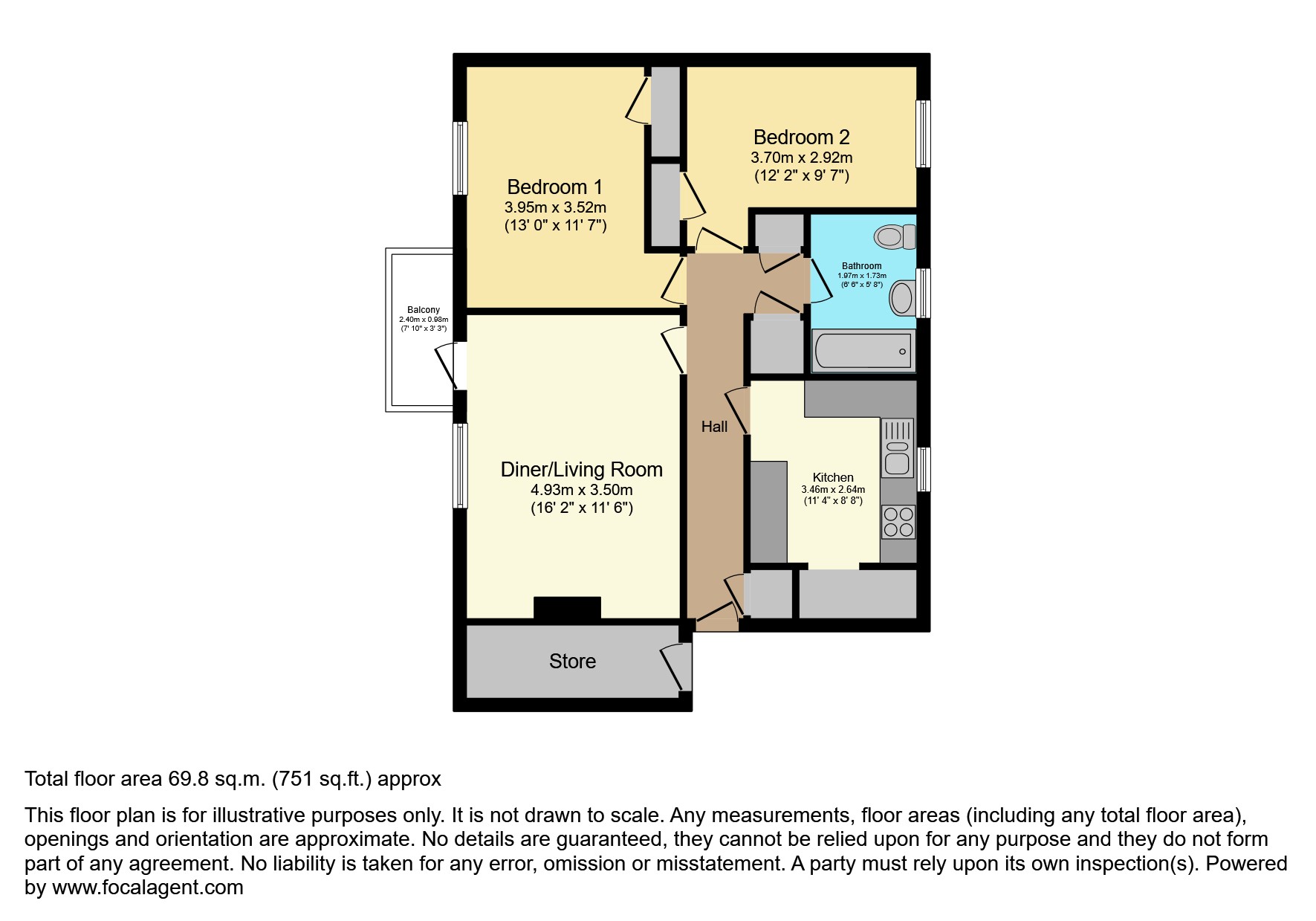

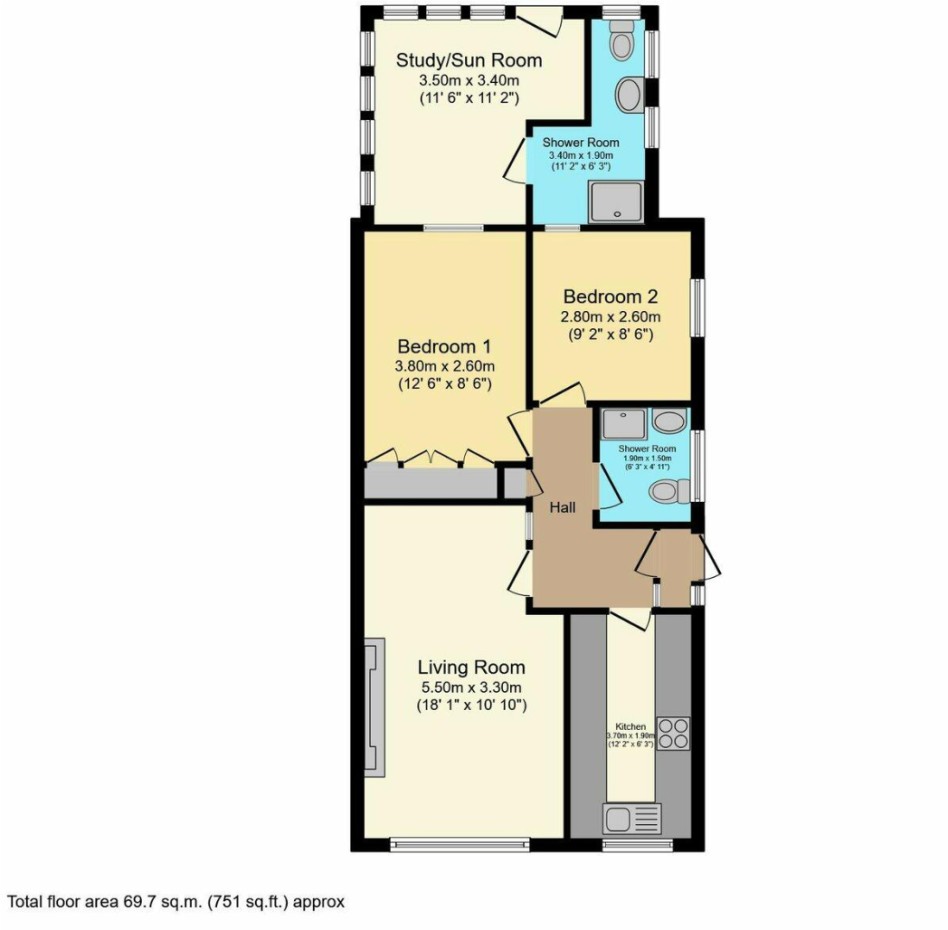

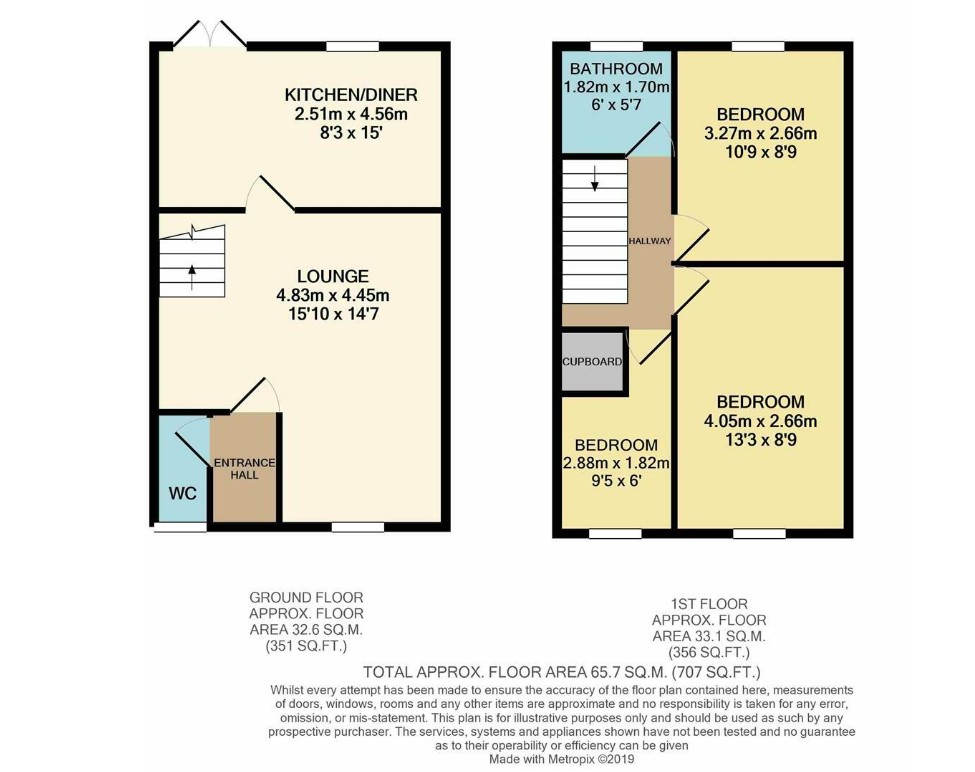

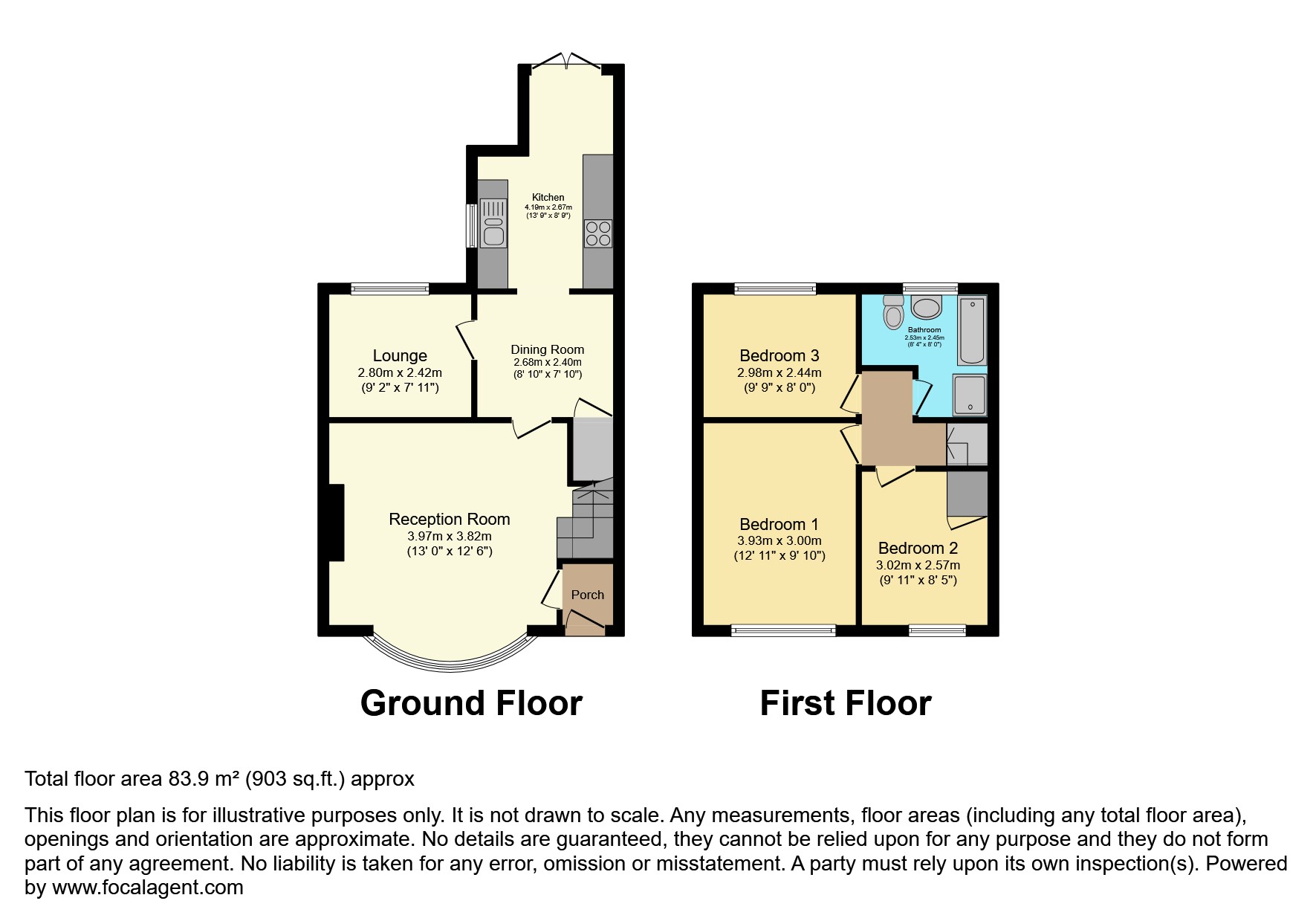

What Type Of Tenanted Properties Do You Sell?

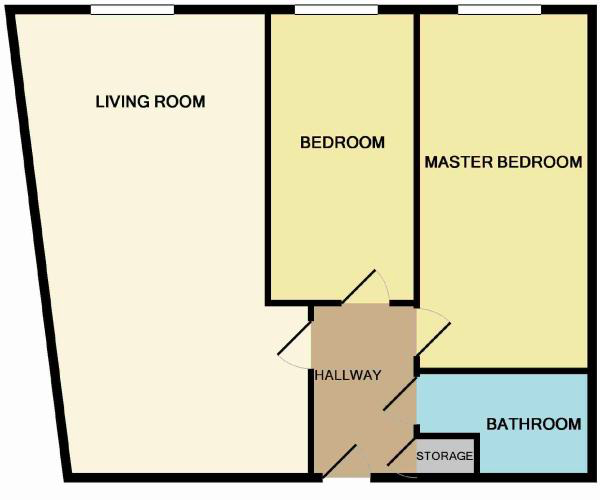

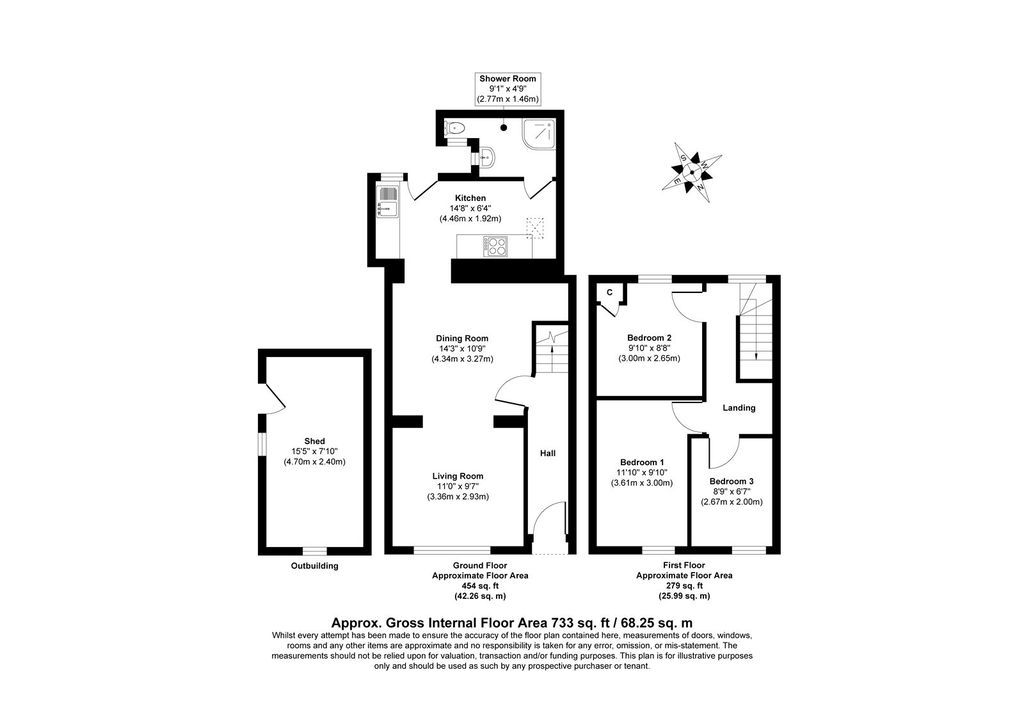

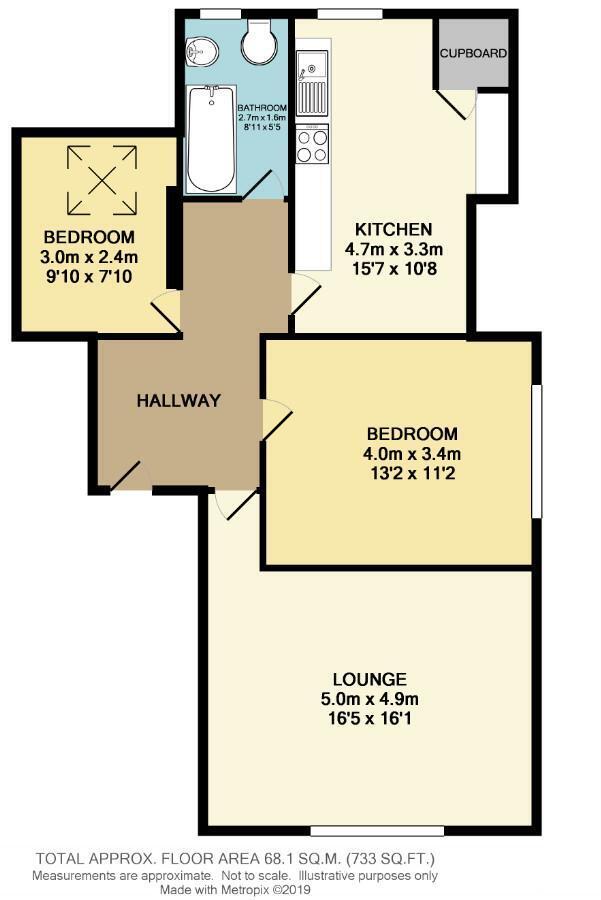

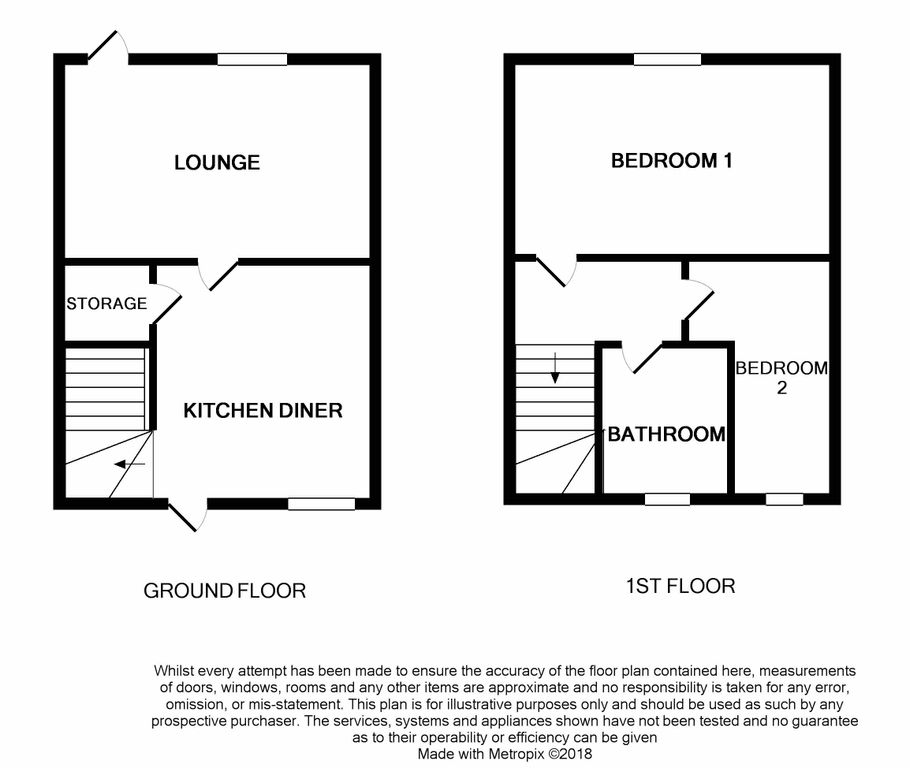

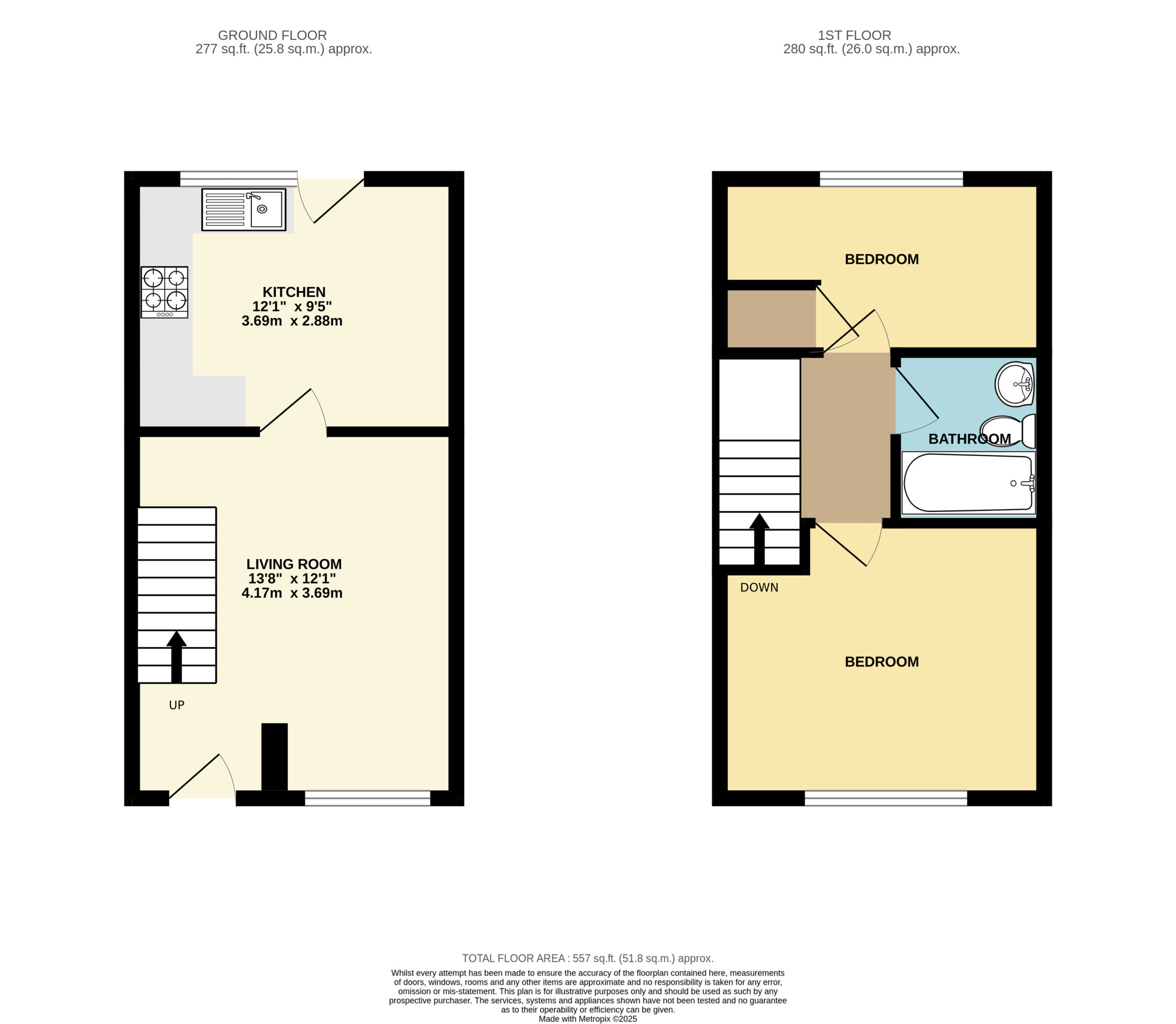

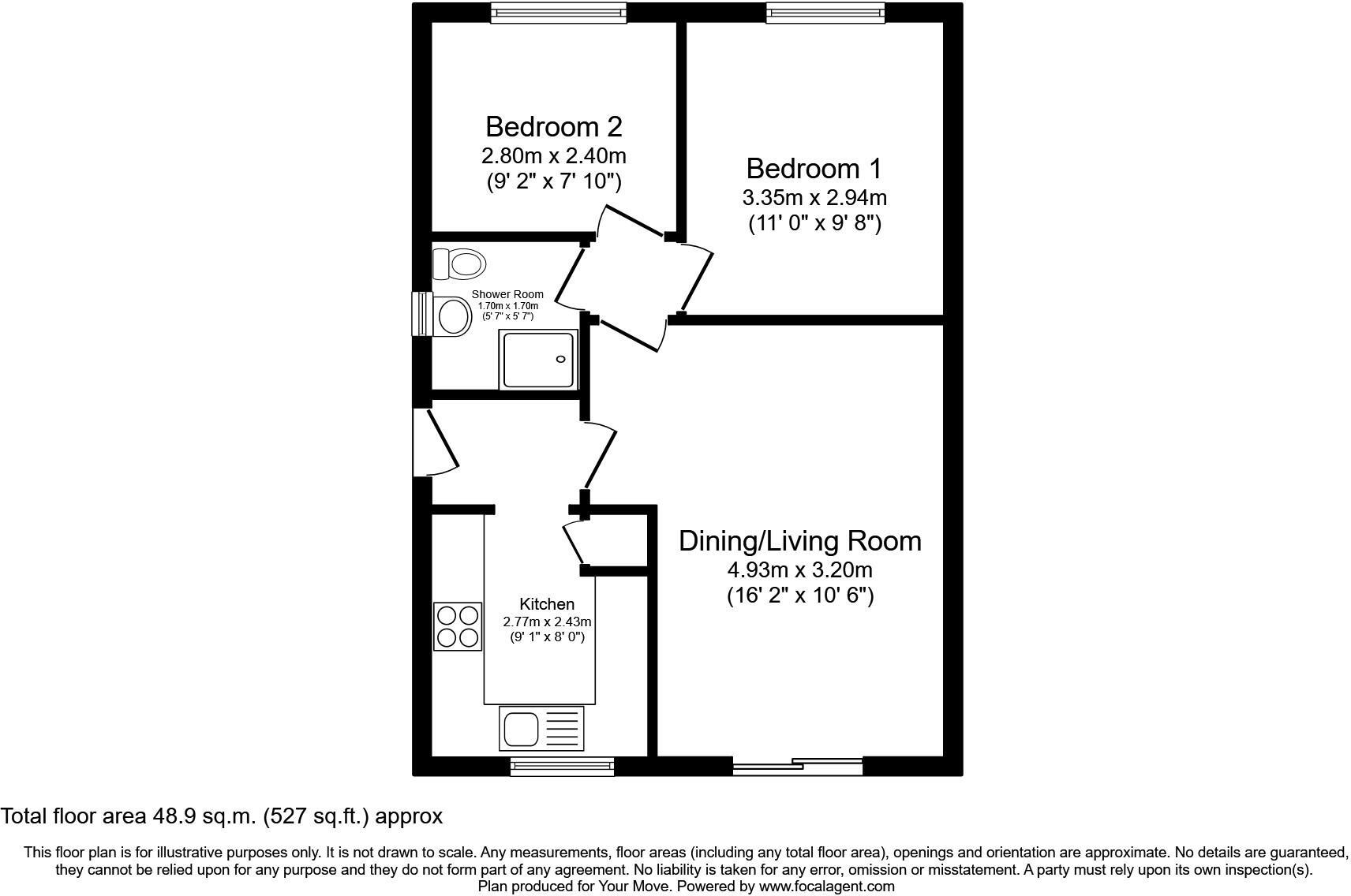

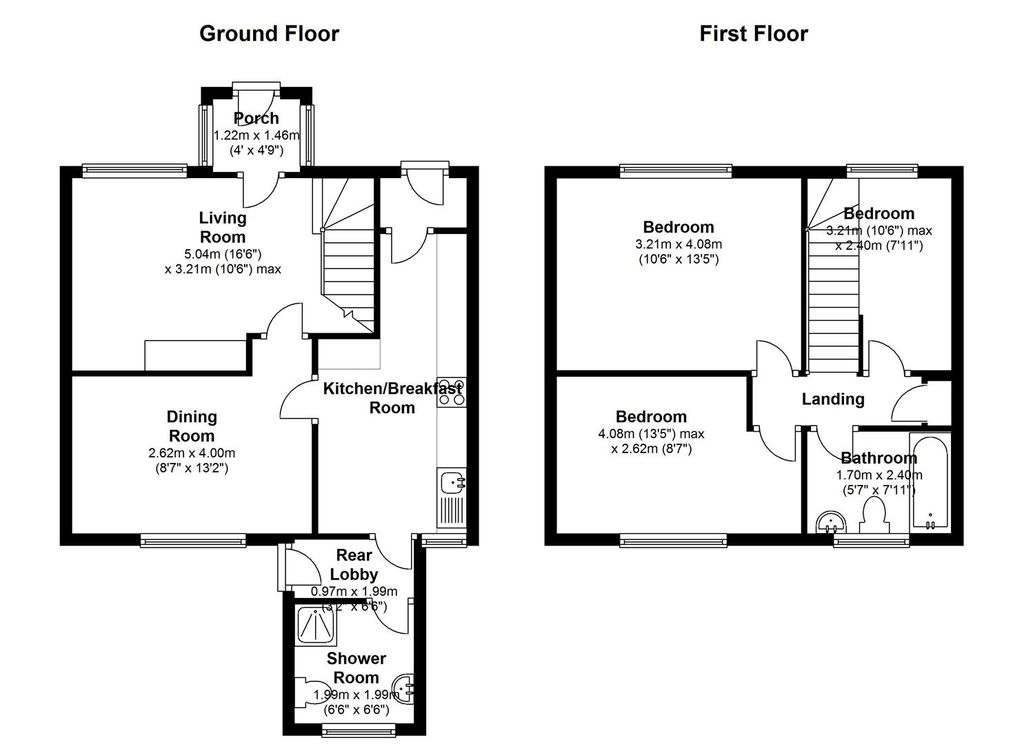

We sell all types of residential tenanted properties, including apartments, studios, houses and HMO’s. For more experienced investors, we also work on larger portfolio sales.

How Much Will You Charge Me To Sell My Tenanted Property?

We charge a fee of 1.25% plus VAT (1.75% plus VAT – London/inside M25) of the sale price (subject to a minimum £2,000.00 plus VAT), on a ‘no sale, no fee’ basis.

A key point to note is that we are wholly incentivised to work on your property through to the successful completion of sale. In other words, we do not get paid our fee until you get paid your proceeds from the property sale. This is a crucial and often overlooked point, as it ensures we continue working hard on your sale after the reservation, thereby giving you a far higher chance of a successful sale!

What Is Your Contract Duration?

A well-priced property should be able to generate interest straight away, and as such our sales agreements are for a fixed term of 10 weeks. If the property remains unsold after the 10-week marketing period, it would be removed from the open market and our agreement would come to an end.

I Want To Sell An HMO Property, Do Pure Investor Offer This Service?

With a database of over 31,000 global property investors, we have a large number of investors looking to buy HMO properties and every day we generate enquiries from clients looking to invest in these types of properties. If you are thinking of selling your HMO property, why not take a read of our comprehensive Guide To Selling An HMO Property, which will give you a comprehensive breakdown of what’s involved in selling an HMO, and what to do in order to maximise your value and achieve a successful completion.