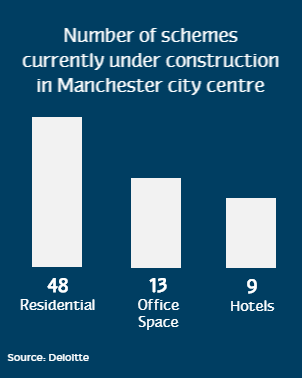

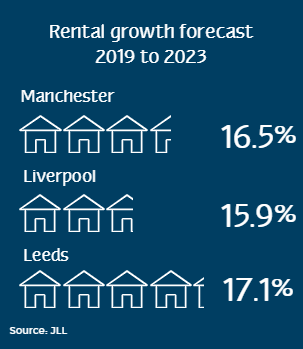

We focus on residential and commercial properties, looking particularly at the how many commercial properties are under construction in Manchester city centre. We also look if long term or short term lets are the option for you, outlining the rental growth forecast for 2019 to 2023.

There are all kinds of property-investment options available but the good news is that you can get a good idea of which one is right for you by answering a few simple questions.

There are all kinds of property-investment options available but the good news is that you can get a good idea of which one is right for you by answering a few simple questions.

Up until relatively recently, many property investors would simply have ignored commercial property. For the average amateur or “accidental” landlord, residential buy-to-let was the only way to go. These days, however, the residential buy-to-let market is heavily regulated.

Up until relatively recently, many property investors would simply have ignored commercial property. For the average amateur or “accidental” landlord, residential buy-to-let was the only way to go. These days, however, the residential buy-to-let market is heavily regulated.

This is not necessarily a bad thing and hasn’t put investors off the residential buy-to-let market, however if the extra administrative burden is something you would rather avoid, there are alternatives.

Commercial property works to a different set of rules even though some of it effectively functions as residential property, for example purpose-built student accommodation and hotel room investments.

Again, up until recently, this was a question many property investors would just have overlooked. At this point, however, the short-term lettings market is booming to the point where it is a good idea for investors to research it even if they decide that it is not for them.

Again, up until recently, this was a question many property investors would just have overlooked. At this point, however, the short-term lettings market is booming to the point where it is a good idea for investors to research it even if they decide that it is not for them.

The first key point to understand is that short-term lets are much more labour-intensive than long-term rentals. Basically, you’re proving serviced accommodation.

The higher yields form short-term lets can justify employing people to look after your property for you, but this cost will, of course, have to be factored into your calculations.

The second key point is that property investors in this area will have to keep a particularly sharp eye not only on the law as set out by Westminster, but also on local bylaws, both of which can and do change.

There are two ways property investors could “hedge their bets” against unwelcome changes.

One is to look for properties in rural areas, where the local economy is very much geared towards tourism.

The other is to look for property in areas where there is strong demand for both short-term and long-term lettings, such as Fairfield in Liverpool.

The HMO sector is considered highly-regulated even by the standards of the UK’s private rented sector. What’s more, as mentioned above, regulations can and do change and the onus are on property investors to keep on top of these changes.

Having said that, HMOs are still an extremely popular choice with many tenants, especially young adults (both students and young professionals) and as such can bring good yields.

They do require a bit more administration than letting to single tenants or groups, but the flip side of this is that it is highly unusual for all tenants to leave at the same time so investors will generally have some income coming in even if some of the units are empty.

HMOs also offer landlords the opportunity to “mix and match” their letting style, for example they could use some units for short lets and some units for standard, long-term rentals.

If you would like to discuss any property investment opportunities or are looking to sell your investment, feel free to contact us on 0161 660 9684 or email us on enquiries@pureinvestor.co.uk