What is a HMO Property?

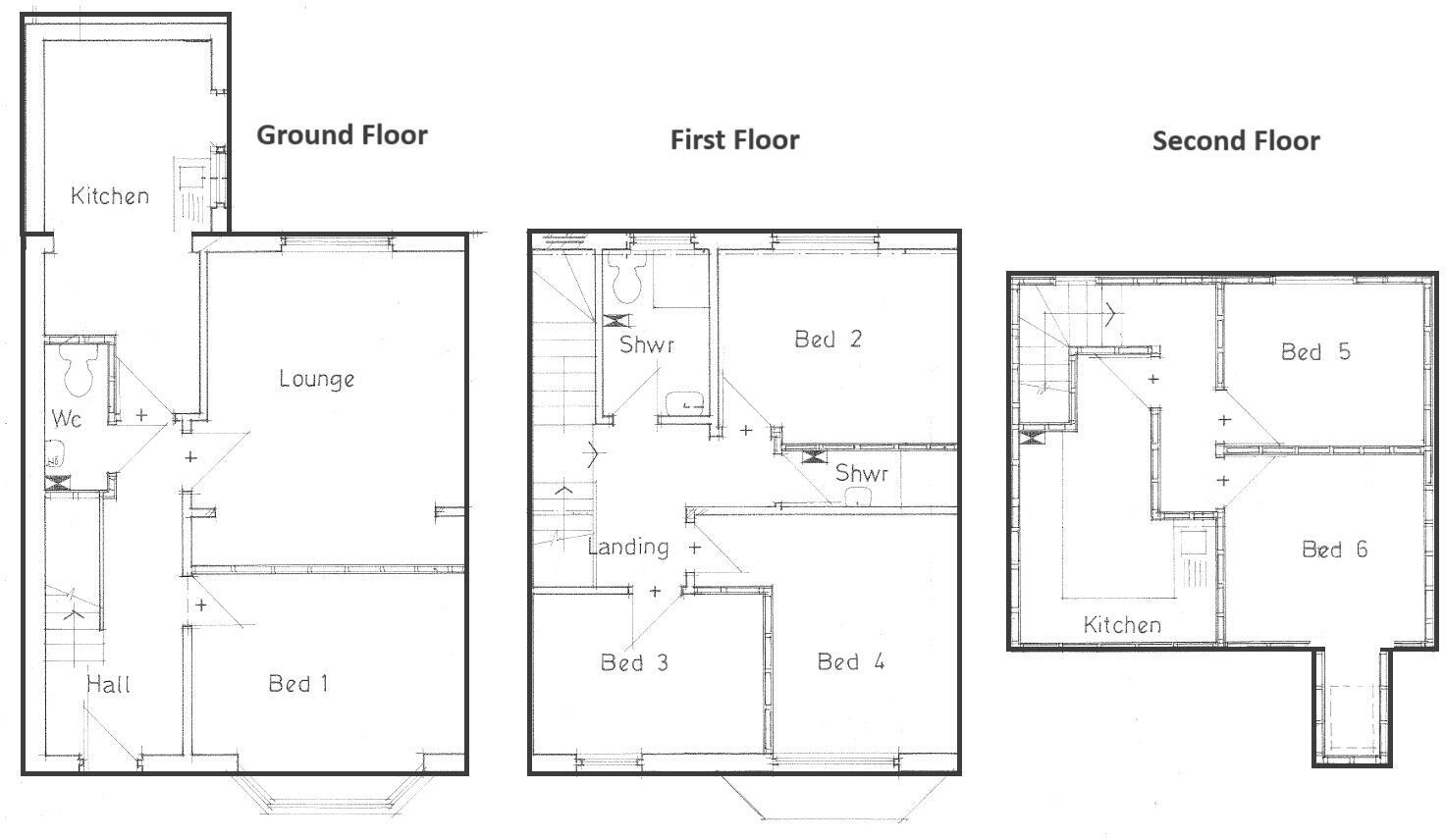

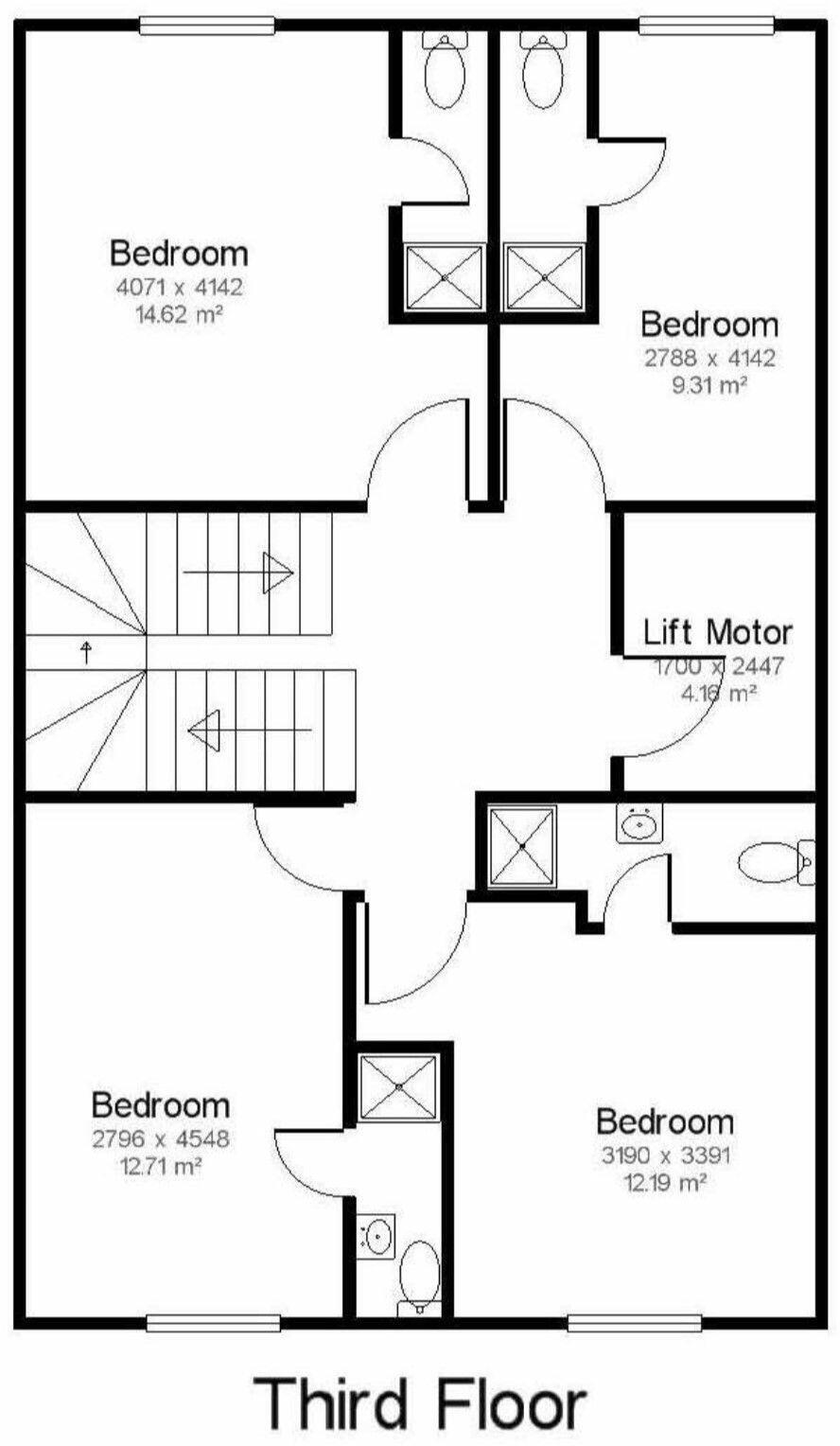

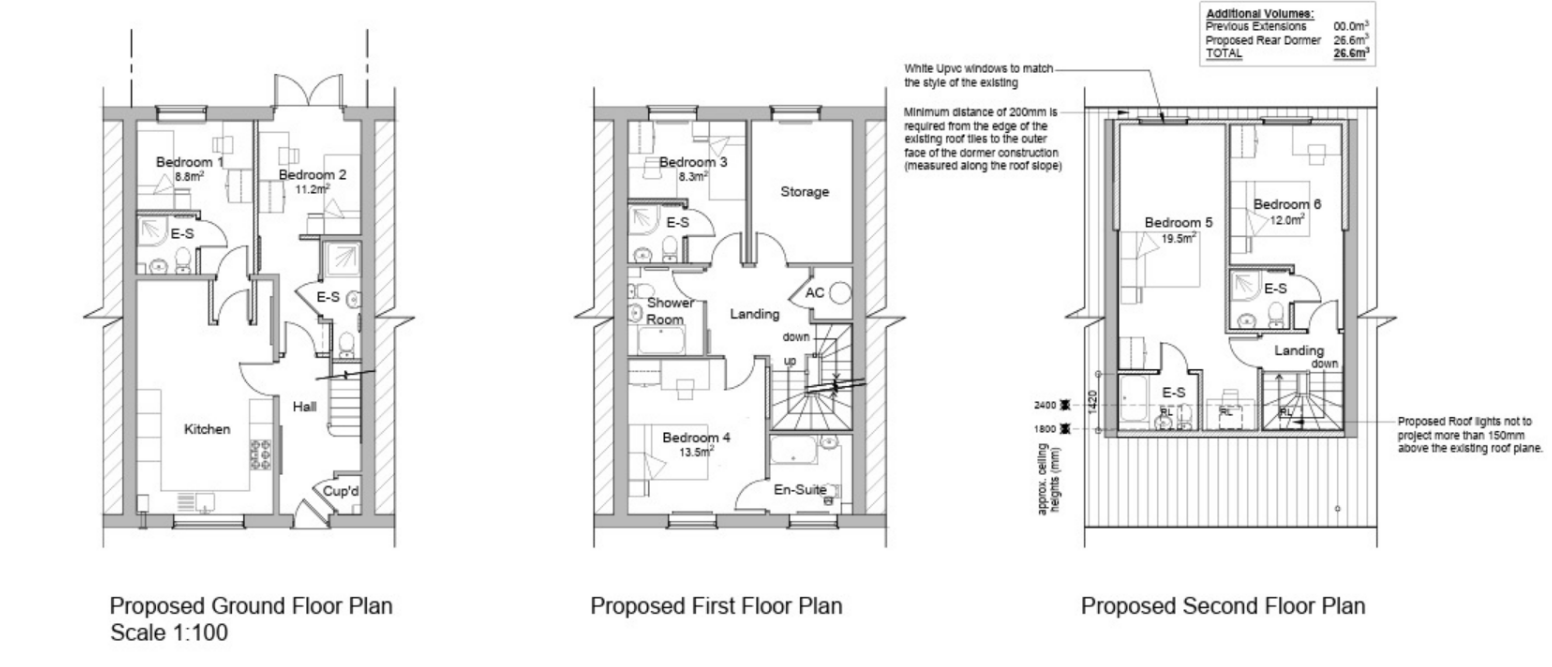

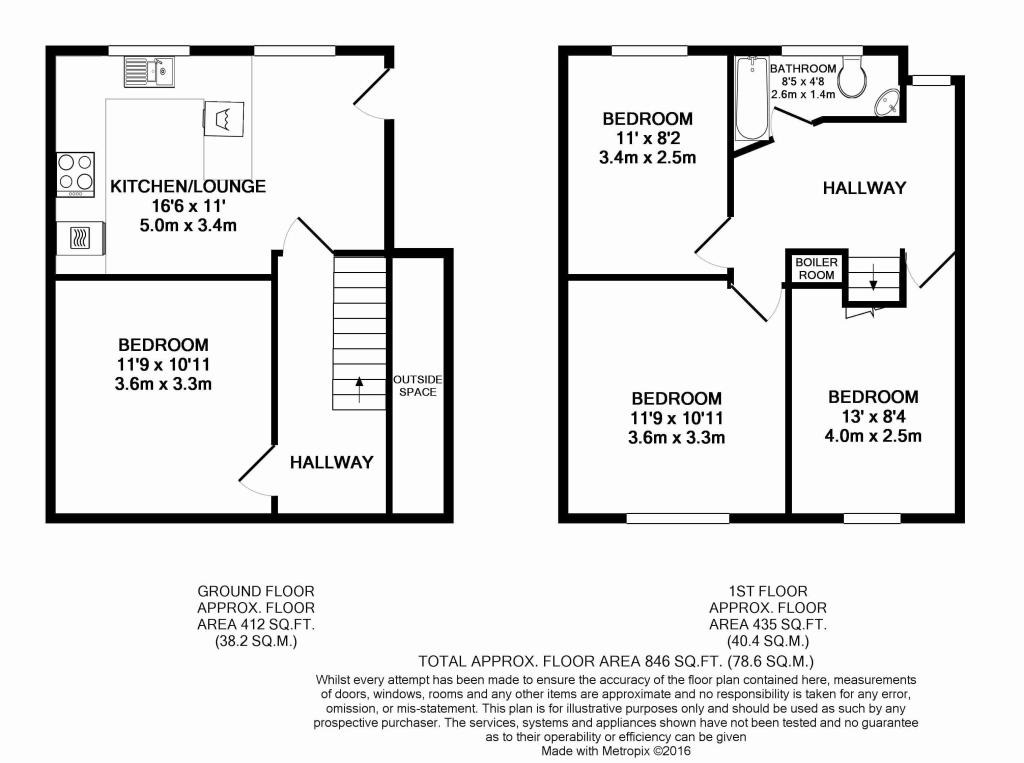

A HMO (House in Multiple Occupancy) is a type of property that is rented to at least 3 tenants (not related) who form more than one household. HMOs will typically have shared facilities such as toilets, bathrooms, or kitchens.

In the UK large HMOs (rented to at least 5 separate tenants) require a license in order to operate. HMOs can offer landlords multiple rental incomes from a single property as each room can be rented out separately. Some common examples of HMO properties include; shared houses and student halls of residence.

Why invest in HMOs?

Higher Rental Yields Than Single Buy To Let Properties

In its purest sense, and looking solely at the figures, investing in a HMO makes sense for investors looking to generate a higher rental yield.

The HMO properties that Pure Investor bring to market typically offer in the region of 8 – 12% rental yield, and whilst there are undoubtedly regional variations within these figures (as there are in single residential buy to lets), the average HMO will undoubtedly deliver a higher average return due to the fact that the one property has multiple different tenancies paying a rental income each month.

Regardless of whether the HMO focuses on young professionals or students, the reality is that they are cash generative, and as such are currently in high demand from property investors seeking to develop their portfolios.

Less Exposure To Rental Voids and Arrears

As most investors will be aware, the current cost of living crisis has resulted in an increased exposure to rental arrears and voids in the market, with tenants finding an increasing level of difficultly in being able to keep up with their monthly outgoings.

Within an HMO, the landlords rental income is split between a larger number of tenants, thereby lowering the level of risk to your monthly rental income.

As with tenants, Landlords are also balancing higher monthly outgoings due to the current economic climate, and as such this lowering of risk through default or arrears is hugely appealing to landlords.

Increasing Demand For HMO Style Accommodation

In recent years, more robust legislation on HMO has resulted in a market wide increase in standards and specification throughout the HMO sector. This has resulted in a broadening of the appeal of HMO style accommodation to both students, and more importantly young professionals. Within the student sector, HMO style accommodation has always proven attractive as a lower cost style of accommodation, which also offers an enhanced social environment from which many student benefit.

More recently, the rising standards of HMO properties throughout the UK has resulted in a large increase for this type of accommodation from young professionals, many of whom feel priced out of standard residential buy to let properties. This increased demand from young professionals has led to many HMO landlords redoubling their efforts with regards to the appeal of their investment properties.

High specification rooms, and better locations (close proximity to major hospitals and city centres) has created a new wave of HMO’s where residents experience a more enhanced and attractive living environment, resulting in higher satisfaction ratings and ultimately longer tenancies.

In recent years, and following significant efforts by the government, local authorities and other vested interests, there has been an increased emphasis on the standard of offering within HMO properties throughout the country. As a result of this, many HMO’s now offer a far higher standard of living, which is resulting in a significant increase in demand for single rooms from tenants who have previously not considered living in a shared property as an option.

Today, here at Pure Investor we are seeing increasing numbers of landlords looking to accommodate the rising demand from these more discerning tenants. This has created not just a rise in the standard of the typical HMO property, but also an increased rental yield for the investor.

Similar to the rise in standards seen in the student sector on the back of the drive towards new build city centre PBSA, HMO landlords are now reacting in a positive manner towards this increased demand for high standard rooms to rent.